Casual Five Financial Statements How To Calculate Current Ratio From Balance Sheet Example

Quick Ratio 642-393543 046X.

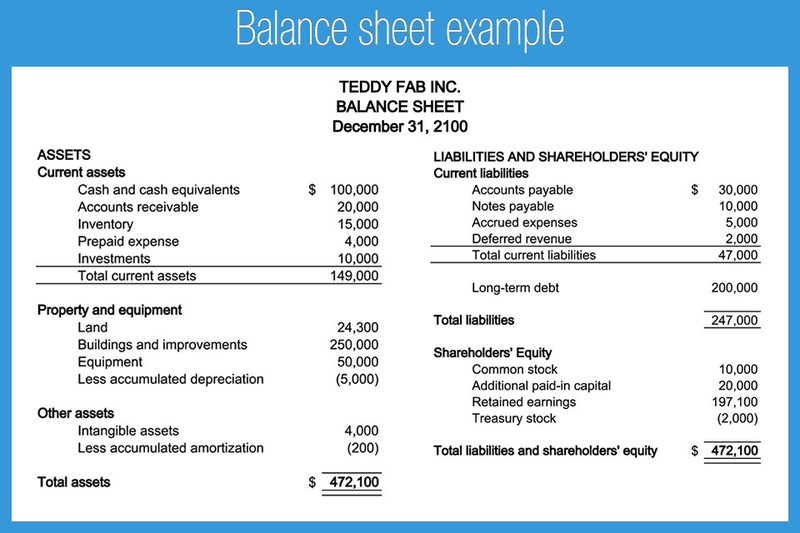

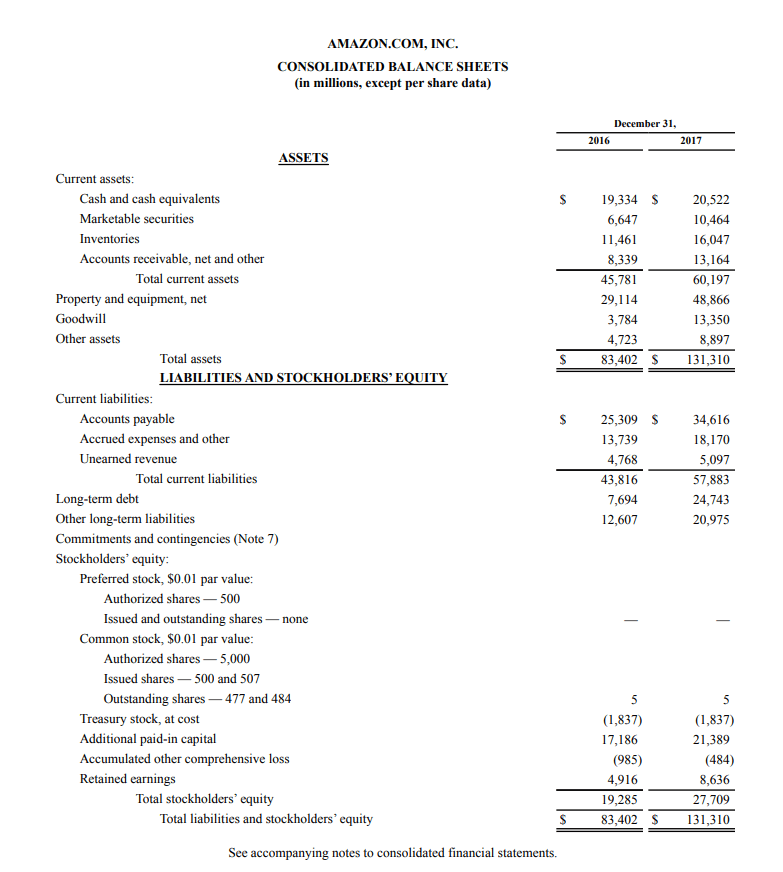

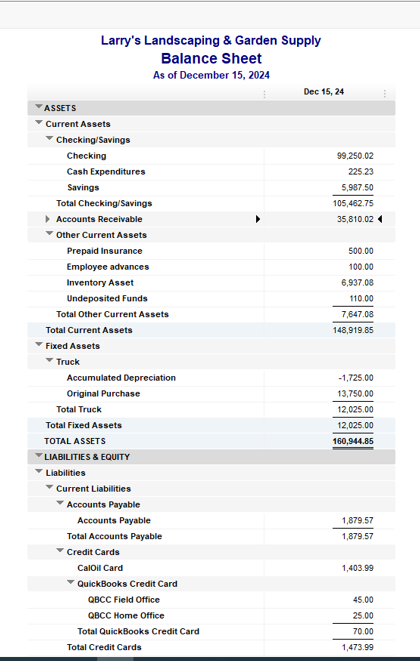

Five financial statements how to calculate current ratio from balance sheet example. It indicates the financial health of a company. Balance sheet ratios evaluate a companys financial performance. When you enter your asset and liabilities this balance sheet template will automatically calculate current ratio quick ratio cash ratio working capital debt-to-equity ratio and debt ratio.

There are three types of ratios derived from the balance sheet. For 2011 the answer is 052X. The goal is to calculate and analyze the amount change and percent change from one period to the next.

Liquidity ratios show the ability to turn assets into cash quickly. Summary of Financial Ratio Calculations This note contains a summary of the more common financial statement ratios. 5 Important Ratios for Measuring Company Health.

The ratio considers the weight of total current assets versus total current liabilities. Consistency and the intuition underlying the calculated ratio are important. This list is not exhaustive.

Solvency ratios show the ability to pay off debts. Divide the result by Total Current Liabilities. Expressed as a formula the current ratio is.

In order to calculate the quick ratio take the Total Current Ratio for 2010 and subtract out Inventory. 14138277 Step 2 Current liabilities. Income Statement for the year ending 30 September 2014 and 2015.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)