First Class Financial Ratios Of Maruti Suzuki

Operational Financial Ratios.

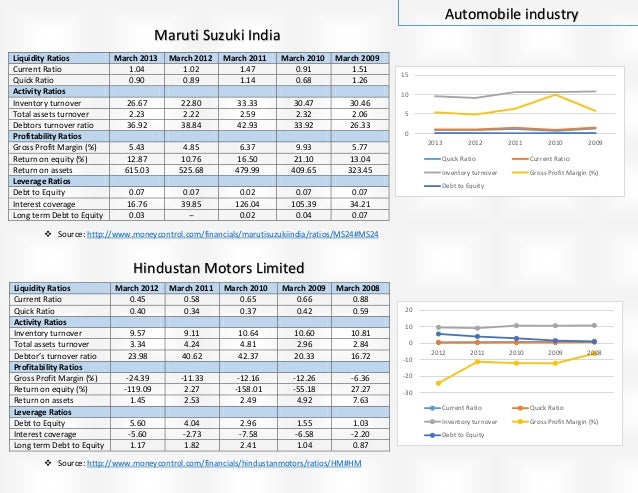

Financial ratios of maruti suzuki. Earnings Per Share Rs 18795. The companys consolidated profits exceeded those of the previous year with 794 billion of operating income 1032 y-o-y 938 billion of ordinary income 1178 y-o-y and 289 billion of net income 1054 y-o-y. Key Financial Ratios of Maruti Suzuki India in Rs.

The ROE after subtracting preferred shares tells common shareholders how effectively their money is being employed. The EVEBITDA NTM ratio of Maruti Suzuki India Limited is significantly higher than the average of its sector Automobiles. Ideal long term average ROE should be above 15.

Return on Capital Employed 837. Operational Financial Ratios. Average 2 year ROE of Maruti Suzuki India Ltd.

Explore the net sales PAT and sales volume under domestic and exports unit of the Maruti Suzuki India Limited. Presentation OnRatio Analysis on Maruti Suzuki. Quick Ratio x 029.

Basic EPS Rs 14530. Per Share Ratios. Fixed Assets Turnover Ratio.

Until recently 1828 of the company was owned by the Indian government and 542 by Suzuki of Japan. Ideal current ratio is 21. Net Profit Margin 425.