Wonderful Define Cash Flow From Operations

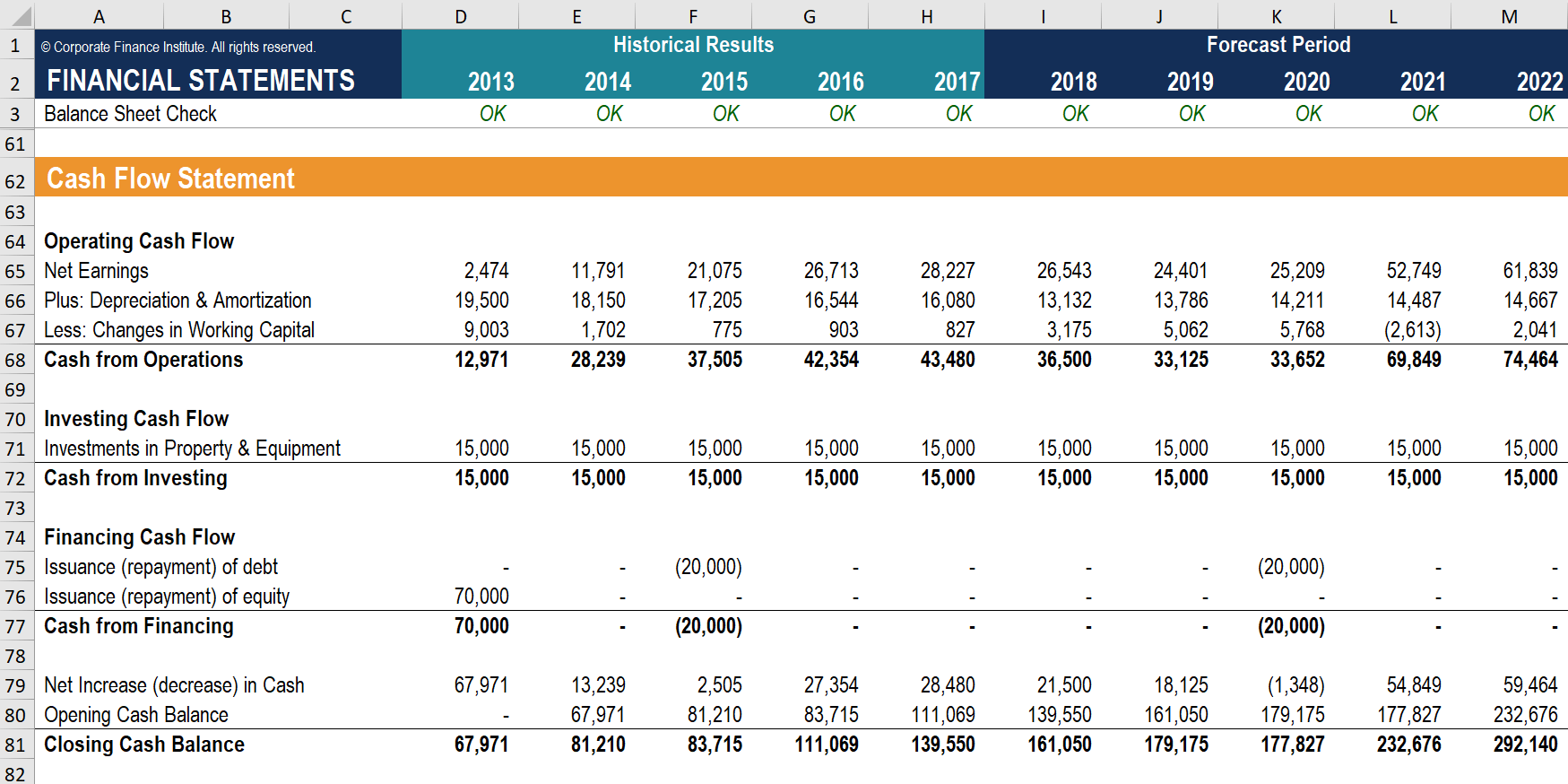

This information is used to determine the viability of the core operations of a business since positive cash flow is needed to maintain and grow a firms operations over time.

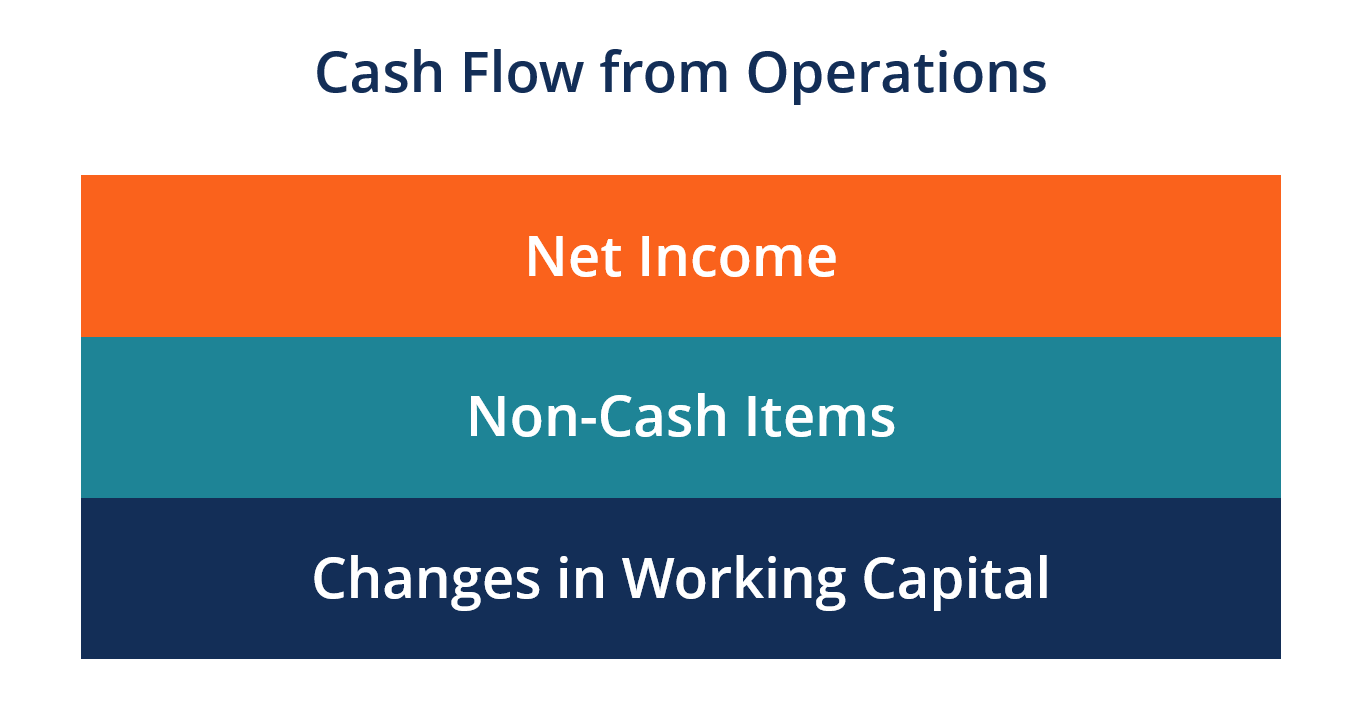

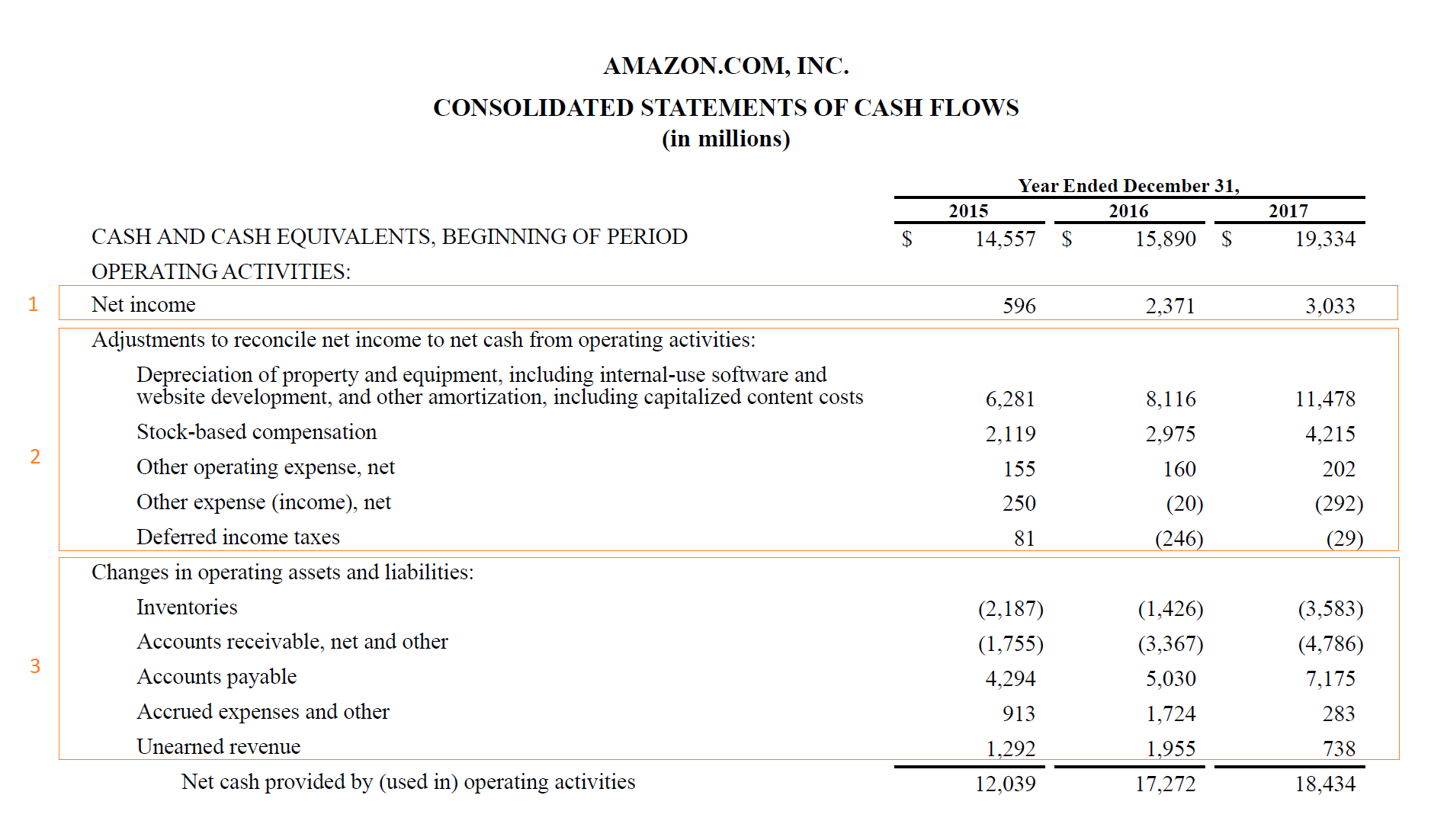

Define cash flow from operations. Increases in accounts receivable are a use of cash if the company didnt collect all of its sales or used cash to produce the increase. Operating cash flow OCF also known as cash flow from operations is the total amount of cash generated by a firm during a given period from its core business activities. Cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company generates or consumes from carrying out its operating activities over a period of time.

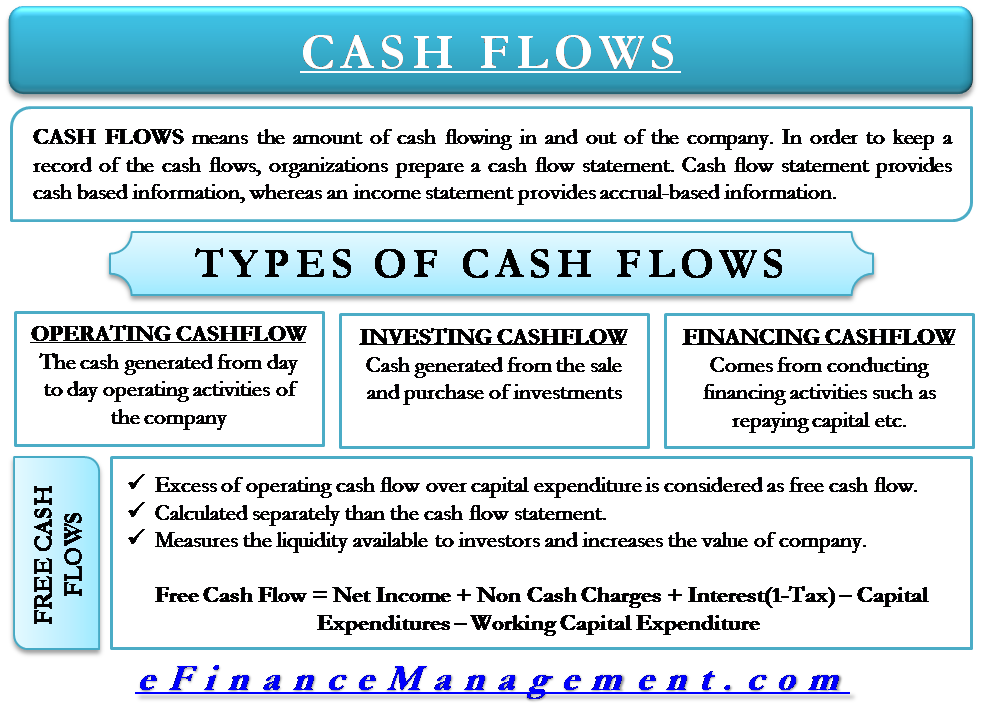

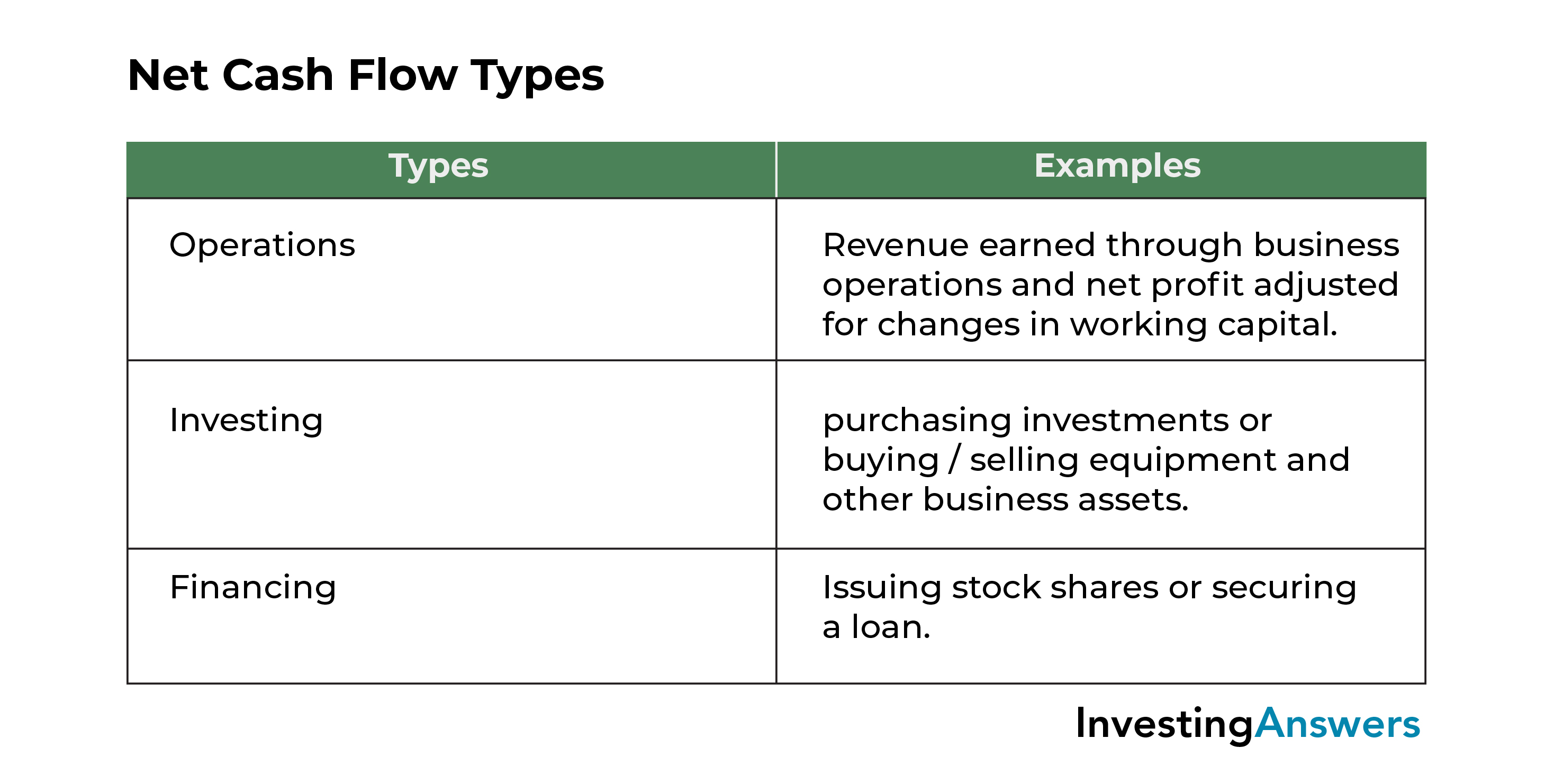

Cash flow from operating activities CFO indicates the amount of money a company brings in from its ongoing regular business activities such as manufacturing and selling goods or providing a. Cash flow is a measurement of the net amount of cash. A ratio of a companys cash flow to either its net income or operating income.

Operating cash flow OCF is a measure of the cash that a business produces from its principal operation in a specific time period. If youre a beginner when it comes to finances you would probably want to know what the operating cash flow means. It is also known as cash flow from operations.

The latter ratio provides a more accurate description of a companys cash flow while the former takes into account the effects of non-operation transactions on income. Operating cash flow is different than a firms free cash flow FCF or net income. Operating cash flow indicates whether a.

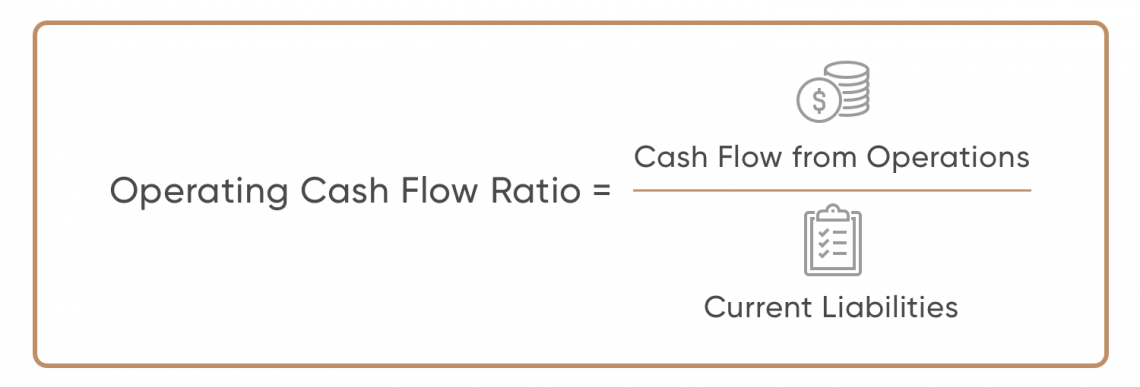

OCF is not the same as net income which includes transactions that did not involve actual transfers of money depreciation is a common example of a noncash expense that is part of net income but not OCF. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. The terms funds from operations FFO and cash flow are related but describe somewhat different concepts.

It is not the same as net income neither EBITDA nor free cash flow. The operating cash flow ratio is a measure of a companys liquidity. Cash-flow-from-operations meaning Cash flow net income plus depreciation expense which is a non-cash charge and deferred taxes adjusted by increases in accounts receivable and accounts payable.

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)