Simple Construction In Progress Cash Flow Statement

Construction in progress is an asset to a business.

Construction in progress cash flow statement. There is no depreciation of the accumulated costs until the project is completed and the asset is placed into service. An unfinished good is a work in progress that has cost you a specific amount to. STATEMENT OF CASH FLOWS CASH FLOWS FROM OPERATING ACTIVITIES Cash received from contracts 9335177 Cash paid to suppliers employees and subcontractors.

If the business will the asset when it is complete it will be a fixed asset. The cash flow projection is wh. The account Construction Work-in-Progress will have a debit balance and will be reported on the balance sheet as part of a companys noncurrent or long-term asset section entitled Property plant and equipment.

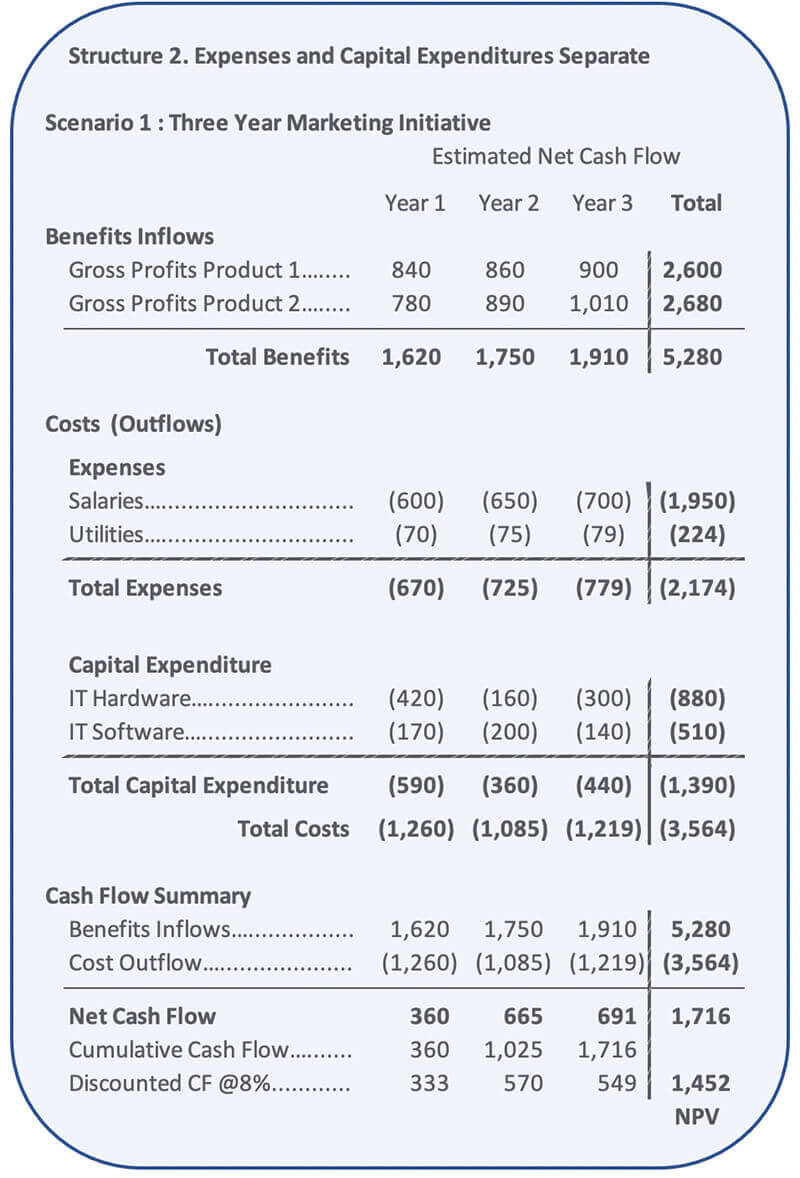

Financial statements like the balance sheet and cash flow statement will show revenues and expenses earlier on so expected cash can at least be factored into analysis and decisions. A cash flow statement in a construction project is pretty similar to the cash flow spreadsheet of any business or project. On the CAAB 101S SPA report the reclass CIP column must net to 0 zero.

The cash flow statement is a historical statement. If the business is building assets under contract to sell they are inventory assets. Asked By Wiki User.

On financial statements prepared using the current financial resources measurement focus agencies must recognize an interest cost incurred before the end of a construction period as an expenditure on a basis consistent with governmental fund accounting principles. Cash received from customers 122918 109369 Cash paid to suppliers and employees 113063 104533 Income taxes paid net of refunds 1911 3876. While it may require a little more accounting knowledge to use accrual accounting can give greater control over financial information.

In depth view into LTS0LSC Construction In Progress explanation calculation historical data and more. When will the first progress payment be received. Construction in Progress Expenditures Incurred but Not yet Paid.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)