Exemplary Accounting For Deferred Tax Projected Balance Sheet Format In Excel

You would require a sheet template to create competent balance sheets for accounting business.

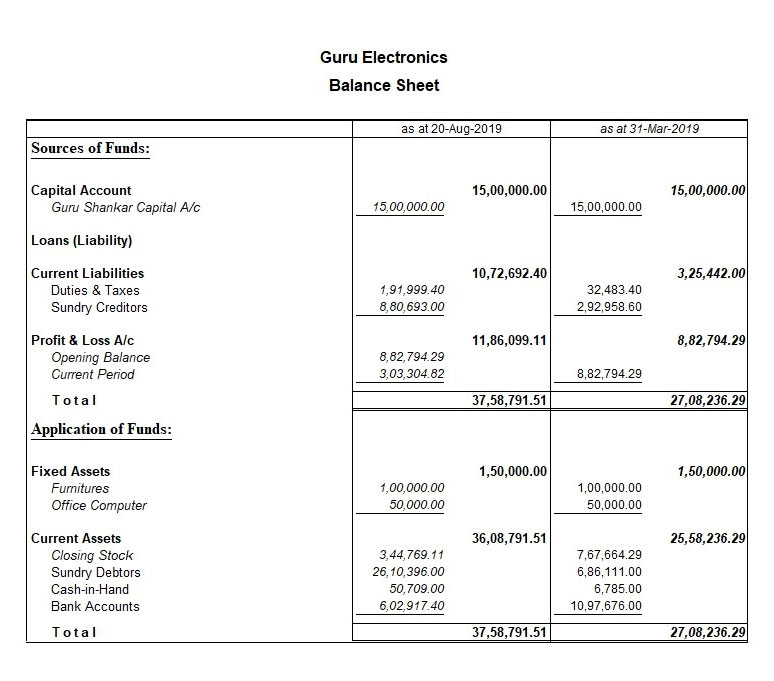

Accounting for deferred tax projected balance sheet format in excel. In short a balance sheet shows what a company owns and what it owes as well as the amount of shareholder investment. Use formulas to reduce the time for calculation. This is your closing balance.

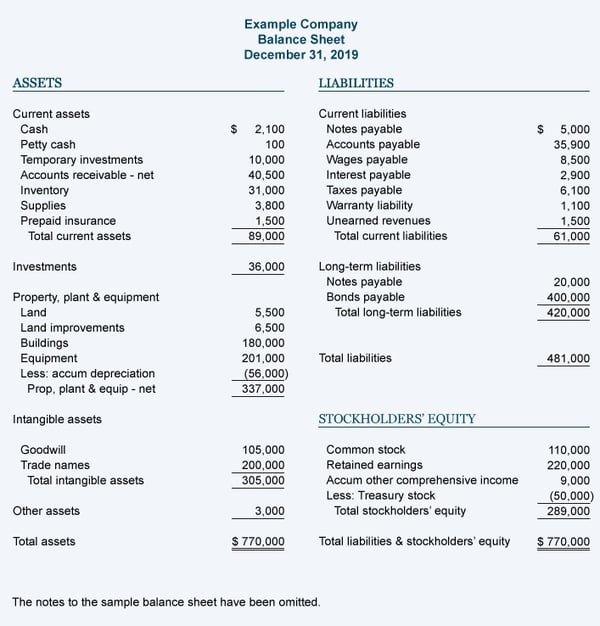

The fields in the tan colored cells of the spreadsheet are left blank for you to enter your own asset and liability figures and you can also change labels for these rows to reflect your own categories of assetsliabilities. By using an Excel balance sheet format you can set up the entries in separate categories. Imagine that we are tasked with building a 3-statement statement model for Apple.

If you need a balance sheet template to account for your deferred revenue then this Accounting Balance Sheet Template is what you need to download. Download Excel Deferred Tax Rate Calculator Templates. Deferred Income Tax Definition Deferred income tax is a balance sheet item which can either be a liability or an asset as it is a difference resulting from recognition of income between the accounting records of the company and the tax law because of which the income tax payable by the company is not equal to the total expense of tax reported.

Tax And Deferred Taxed Computation. Add time for the transactions in the individual column. Utilize and edit it in Google Docs Google Sheets MS Excel MS Word Numbers Pages and Editable PDF.

Elements of Casher Balance Sheet Template Excel. See what benefits you can get in securing a copy of this template today. For example if a corporation s net income for the year is 45 000 the closing entry will be a debit of 45 000 to the income summary account.

Measure deferred tax balances using the balance sheet approach Understand how to account for deferred tax when the revaluation model is elected for property plant and equipment Understand the need for a tax rate reconciliation Prepare a tax rate reconciliation Present and disclose deferred tax in. Financial statements are very essential for any business. After two years the deferred liability has increased to 123 this represents 30 of the difference between the net book value of the plant for tax purposes 1 000 minus 300 minus 210 490 and accounting purposes 1 000 minus 50 minus 50 900.