Cool Duties And Taxes Under Which Head In Balance Sheet

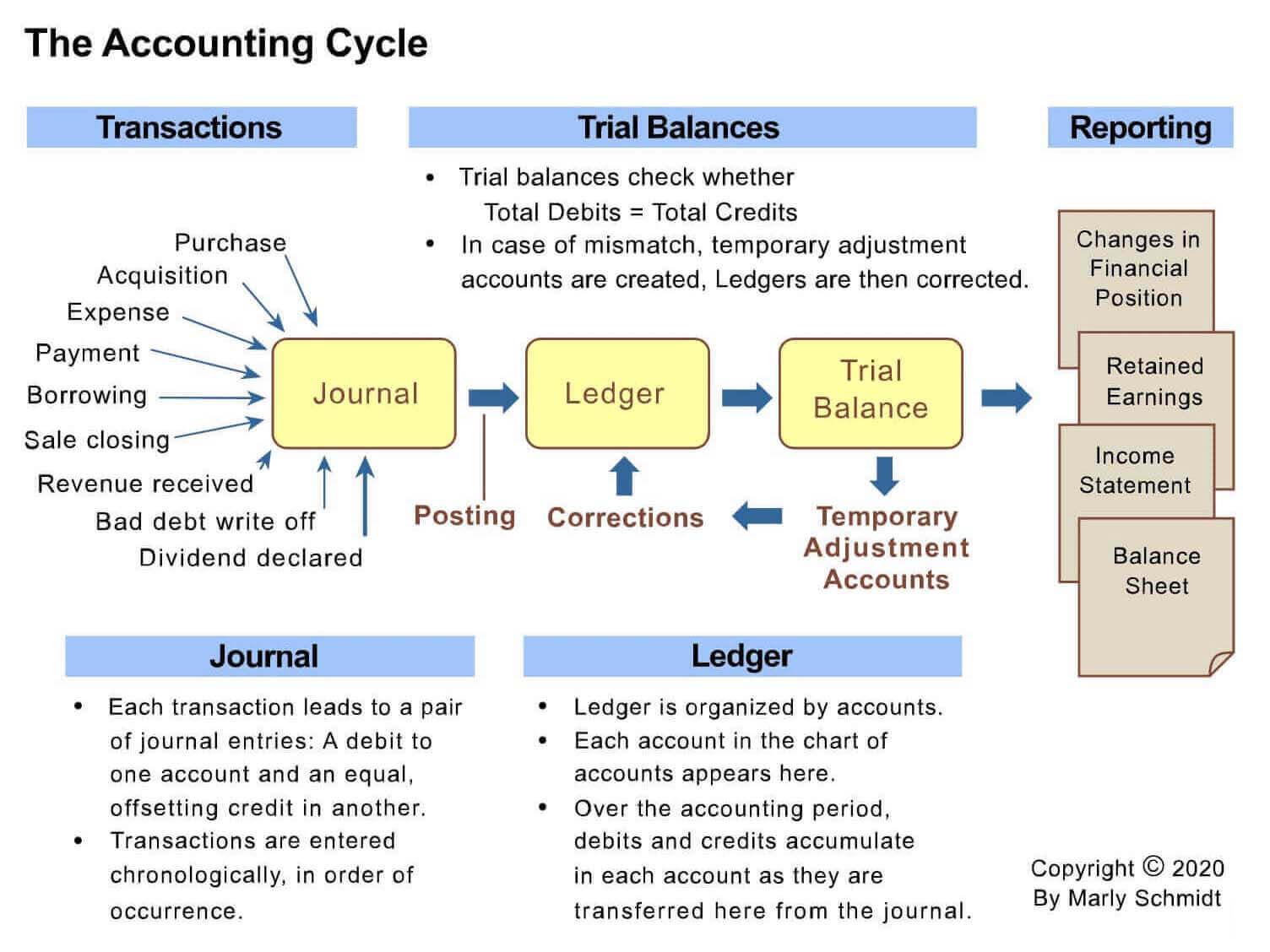

Any expenses included under the head but which is yet to be paid for is to be shown as outstanding liability in the balance sheet.

Duties and taxes under which head in balance sheet. Direct Expenses in Profit Loss Account C. Pradeep Kumar Querist Follow. In India financial year is from 1 st April to 31 st March.

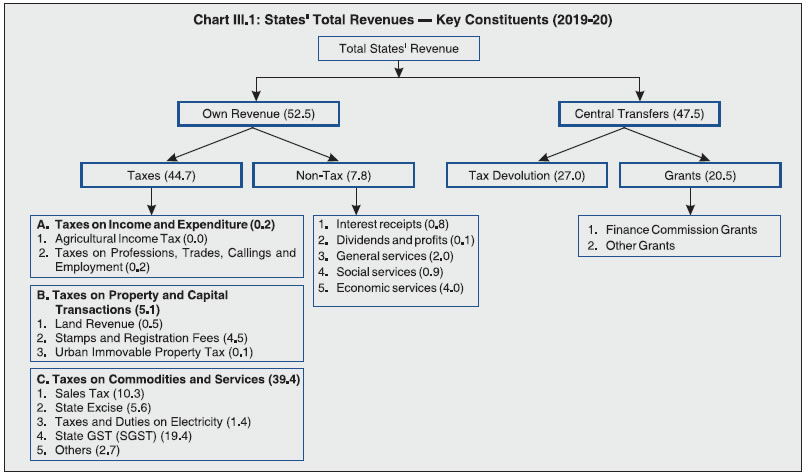

Duties Taxes appear under. The manager also calculates taxes due and finds 30000 or 100000 multiplied by 30 percent. Capital stack ranks the priority of different sources of financing.

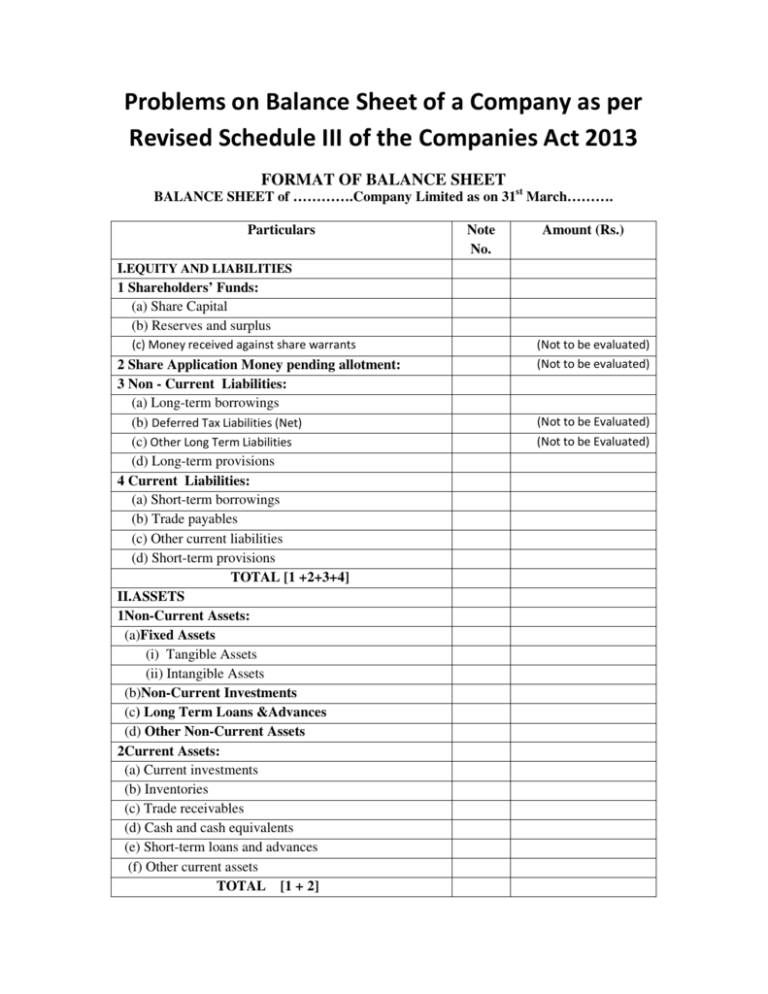

Assets in the Balace Sheet B. In first instance TDS will be shown in Assets side in balance sheets under current assets and in second instance TDS will be shown in balance sheet under current liability. C Liabilities side Duties of Taxes All heads concerning to excise should be created under this head.

They are both paid directly to the government and depend on the amount of product or services sold because the. Purchase of stock items that attract TCS along with items that are not taxable under TCS Create a TCS ledger under Duties Taxes or Current Assets as required to view the amount under the required section of Balance Sheet. When TDS deducted by another person payer when paying to you payee it will be shown under Assets side of the Balance Sheet.

TDS is part of advance tax for the deductee while for deductor its current liability. TDS or Tax deducted at Source can appear in both sides of the Balance Sheet ie. Income taxes payable a current liability on the balance sheet for the amount of income taxes owed to the various governments as of the date of the balance sheet If a corporation has overpaid its income taxes and is entitled to a refund the amount will be reported on the balance sheet as a current asset such as Other receivables.

1 Tax under section 115JC in the assessment year 2021-22 1d of Part-B-TTI 2 Tax under other provisions of the Act in the assessment year 2021-22 2i of Part-B-TTI. Predict Macro Economic. There are three primary types of liabilities.