Fabulous Profit And Loss Account Debit Balance Means

Debit balance of profit and loss account is nothing but defficit for that periodso we can show it as fictiticious asset or we can show it as negative balance in liability side.

Profit and loss account debit balance means. The account that shows annual net profit or net loss of a business is called Profit and Loss Account. The debit balance of a profit and loss account denoted loss. So if Debit Side Credit Side it is a debit balance.

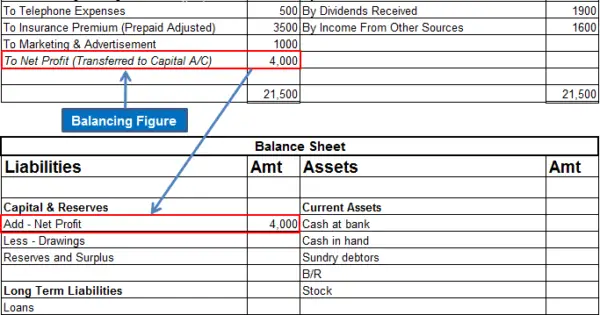

Debit balance of Profit and loss account is called Net profit. It is added to capital account and not on asset side of Balance sheet. The journal entry is credit Profit Loss Account and debit Retained Earnings.

Profit and loss account Definition. Profit and loss account get initiated by entering the gross loss on the debit side or gross profit on the credit side. Debit balance on a profit and loss account means the company has made a loss and that loss is transferred to retained earnings in the Equity section of the Balance Sheet.

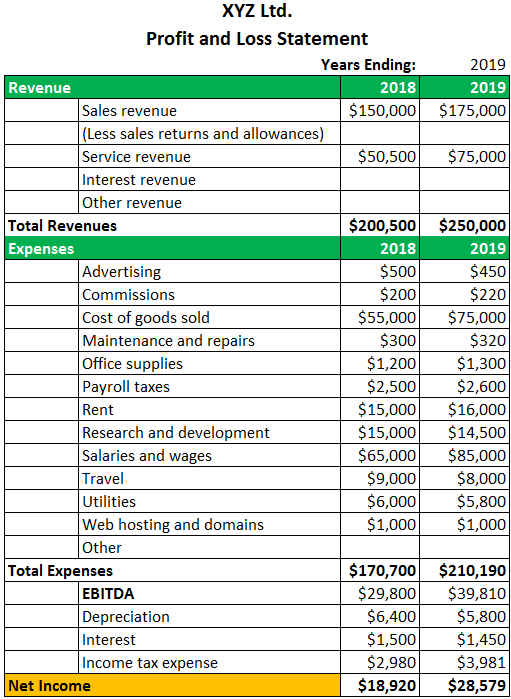

Profit and loss account This is often called the PL for short and it shows your businesss income less its day-to-day running costs over a given period of. When the credit side is more than the debit side it denotes profit. The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year.

A business will incur many other expenses in addition to the direct expenses. This will be the accumulated credit balance in. Hence Credit balance of Profit and loss account is profit.

Prepare Profit and Loss account for the year ending March 31 2018 in the books of Tutorstips Ltd. Ad Find Profit Loss Balance Sheet. Debit balance and credit balance are terms often used in the accounting world hence it is important to understand the distinction and their exact meaning.