Unbelievable Treatment Of Calls In Arrears In Balance Sheet

Accounting Treatment of Calls-in-Arrears There are two methods of dealing with the Calls-in-Arrears.

Treatment of calls in arrears in balance sheet. Without opening Calls-in-Arrears Account. Therefore paid up capital is equal to the called-up capital minus call in arrears. Interest on Calls-in arrears.

Calls in arrears is asset for a company. I Loose Tools ii Retirement Benefits Payable to employees iii Patents iv Interest on Calls in Advance CBSE Sample Paper 2018-19 Answer. All the called amount the called up capital is the same to the paid up capital.

The outstanding amount of debenture allotment and debenture calls are shown in a separate account called call in arrears account. Accounting Treatment of Bill - Sending the Bill to the Bank for Collection Honour Or Dishonour and Insolvency. Under this method we credit the receipt from shareholders to the relevant call account and various call accounts will show debit balance equal to the total unpaid amount of calls.

On a subsequent date when we receive the amount of Calls-in-Arrears we debit Bank Account and credit. Section 52 2 for utilization of Securities Premium Reserve. Those shares on which calls were in arrears will be shown in balance sheet along with calls in arrears amount.

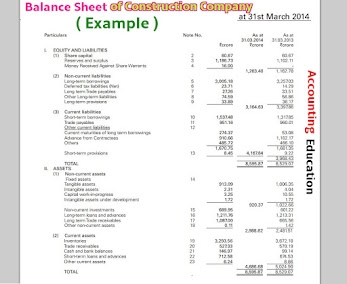

Company is liable to pay 6 interest on call in advance to shareholder Journal Entry for call in Advance. While calls in advance is liability for company. Calls-in-arrears will be deducted from the called-up capital while Other Banks Indian the paid-up value of forfeited shares should be added.

Under which major heads and subheads of the Balance Sheet of a company will the following items be shown. That portion of the subscribed capital which has not yet. Table F for Articles of Association-Rate of Interest on Calls in Arrears 10 pa and Calls in Advance 12 pa.