Great Insurance Industry Financial Ratios

/key_financial_ratios_to_analyze_tech_companies-ss-5bfc3718c9e77c00518293e0.jpg)

220 rows WHAT ARE FINANCIAL RATIOS.

Insurance industry financial ratios. 22 rows Financial ratio Year. Ad Unlimited access to Insurance market reports on 180 countries. Ad Search and synthesize information.

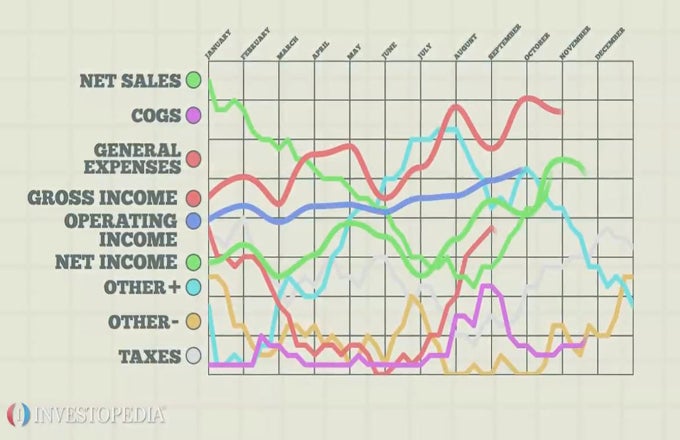

These can be divided into five categories. Instant industry overview Market sizing forecast key players trends. Financial ratios are used to make a holistic assessment of financial performance of the entity and also help evaluating the entitys performance vis-à-vis its peers within the industry.

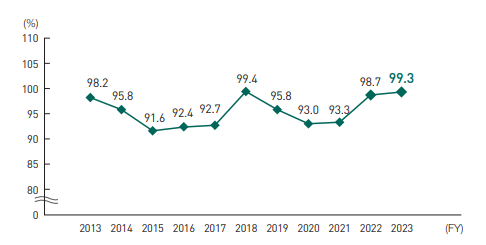

Financial Ratios Insurance Sector In supersession of Financial Ratios Insurance Sector issued in June 2017 Background Financial ratios are used to make a holistic assessment of financial performance of the entity. A combined ratio below 100 means an insurance company is operating at an underwriting profit a profit before adding the returns from investing customers premiums. Instant industry overview Market sizing forecast key players trends.

CARE follows a standard set of ratios for evaluating Insurance companies. Ad Unlimited access to Insurance market reports on 180 countries. 1 Overall the year-to-date total return of SPs Insurance Industry Index lagged the broader SP 500.

22 rows Financial ratio Year. To illustrate North American property-casualty insurers saw first-half annualized GAAP operating return-on-average equity fall to 28 from 83 the year before in large part due to US68 billion in incurred losses related to COVID-19 and concurrent drops in premium volume for key lines. Ad Looking for financial insurance.

Financial ratios are not an end by themselves but a means to understanding the fundamentals of an entity. They also help evaluating the entitys performance vis-à-vis its peers within the industry. 2020 2019 2018 2017 2016 2015.

:max_bytes(150000):strip_icc()/balance_sheet-5bfc2f1246e0fb00514577bc.jpg)

/GettyImages-1085069872_journeycrop_financial_ratios-2beca482cffe497a97be706cc07a2124.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1201625789-e6613ebdb23a4b1a8605019c2d195755.jpg)

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_DuPont_Analysis_Aug_2020-01-254eeb707b3e4ebc9527e054caa914a2.jpg)

/dotdash_Final_DuPont_Analysis_Aug_2020-01-254eeb707b3e4ebc9527e054caa914a2.jpg)

/dotdash_Final_DuPont_Analysis_Aug_2020-01-254eeb707b3e4ebc9527e054caa914a2.jpg)

:max_bytes(150000):strip_icc()/Quick_ratio-5c720ee246e0fb00010762ee.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)