Formidable Impairment Of Goodwill Meaning

Goodwill impairment occurs when the recognized goodwill associated with an acquisition is greater than its implied fair value.

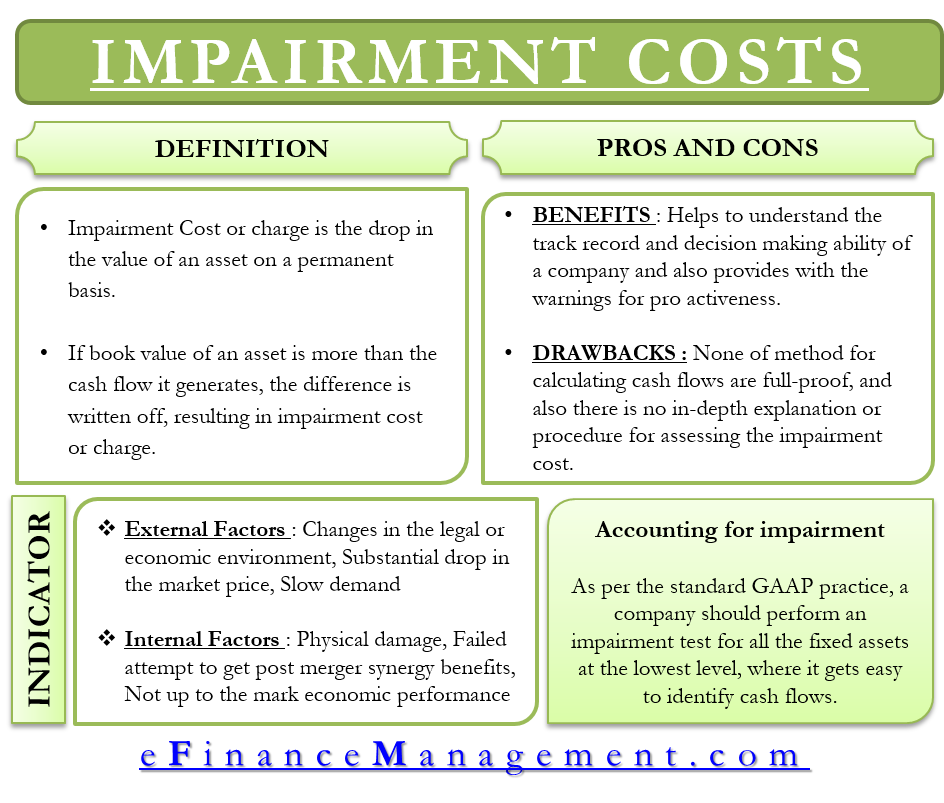

Impairment of goodwill meaning. The impairment test would not identify any overpayments and an impairment of goodwill could be masked by existing unrecognised headroom within the cash generating unit goodwill has been allocated to. Goodwill impairment is an accounting charge that companies record when goodwills carrying value on financial statements exceeds its fair value. In this volatile environment any impairment of goodwill and other long-lived assets has the potential to materially reduce reported earnings.

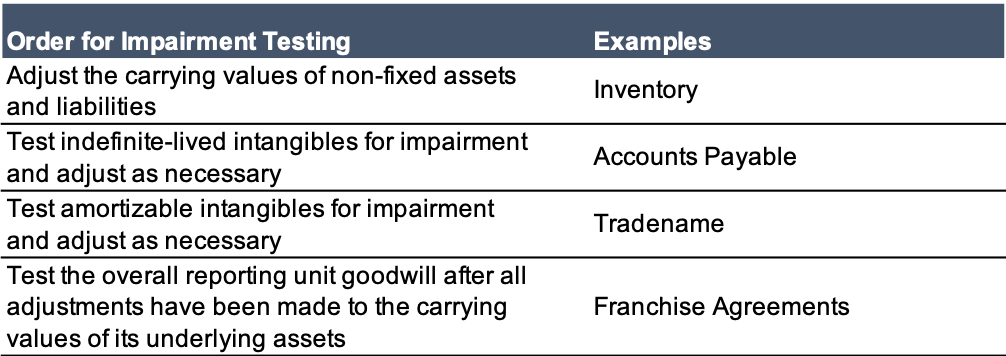

As goodwill is currently tested for impairment as part of a unit the focus on the test is whether the carrying amount of the net assets of the unit including goodwill is overstated. Goodwill Impairment Definition. Goodwill is a common byproduct of a business combination where the purchase price paid for the acquiree is higher than the fair values of.

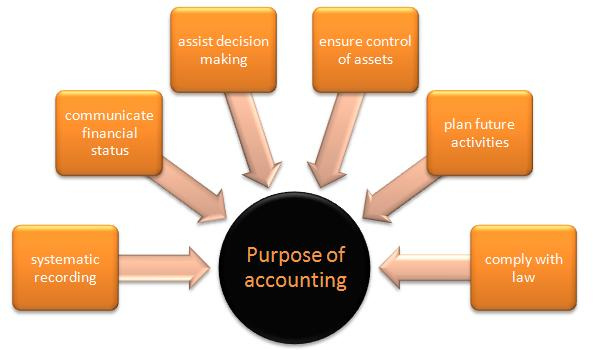

In accounting goodwill is recorded after a. Brand reputation a large customer base strong customer service and important patents all increase a companys goodwill. Allowing goodwill to be tested for impairment at the entity-level or at the level of reportable segments.

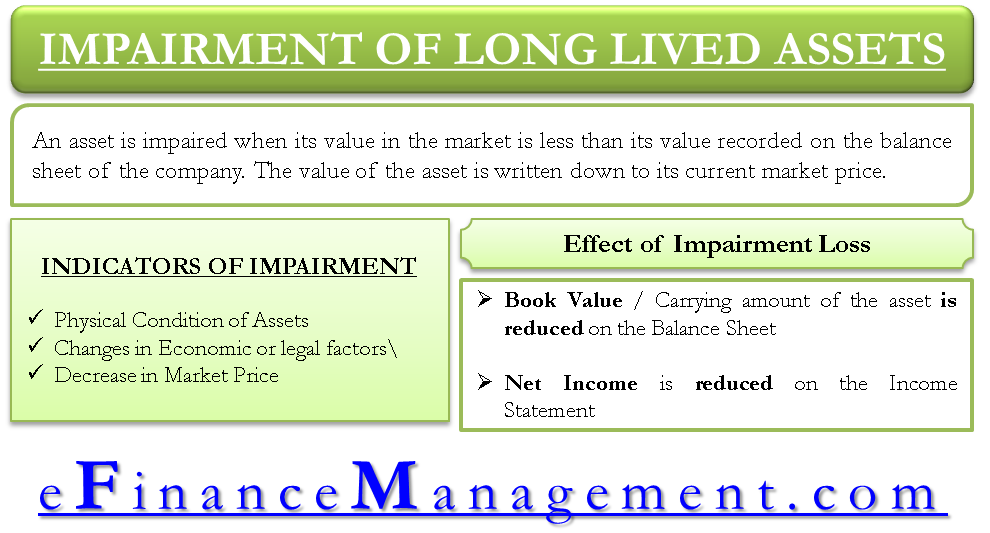

A CGU or a group of CGUs to which goodwill has been allocated is being tested for impairment when there is an indication of possible impairment or 2. Like other assets measured at historical cost in financial statements goodwill is subject to impairment if the carrying value is not recoverable. Goodwill impairment is goodwill that is now lower in value than at the time of purchase.

Requiring disclosure of the payback period of an investment in a business combination. Impairment testing of goodwill. Goodwill impairment occurs when a company decides to pay more than book value for the acquisition of an asset and then the value of that asset declines.

The impairment review of goodwill is really the impairment review of the net assets subsidiary and its goodwill as together they form a cash generating unit for which it. Goodwill is an intangible asset that sellers are willing to pay for. The impairment review of goodwill therefore takes place at the level of a cash-generating unit that is to say a collection of assets that together create an stream of cash independent from the cash flows from other assets.

:max_bytes(150000):strip_icc()/accountingcalculating-5bfc31ba46e0fb00517d103f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1083343894-169a80c978d948a5bb343c68f4d0b2ab.jpg)