Breathtaking Negative Payroll Liabilities Balance Sheet

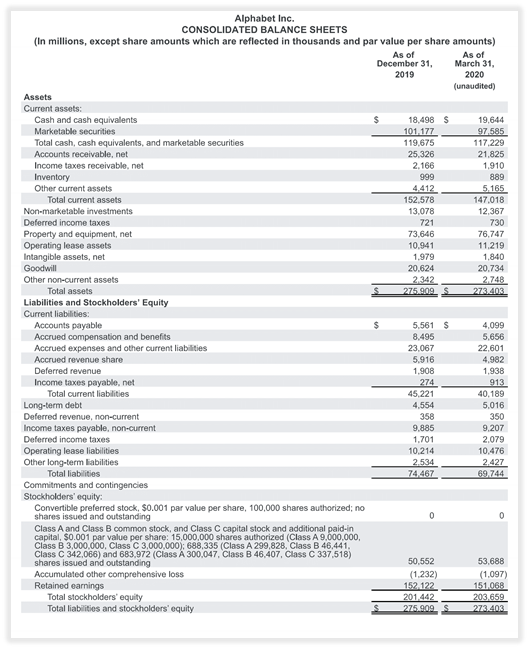

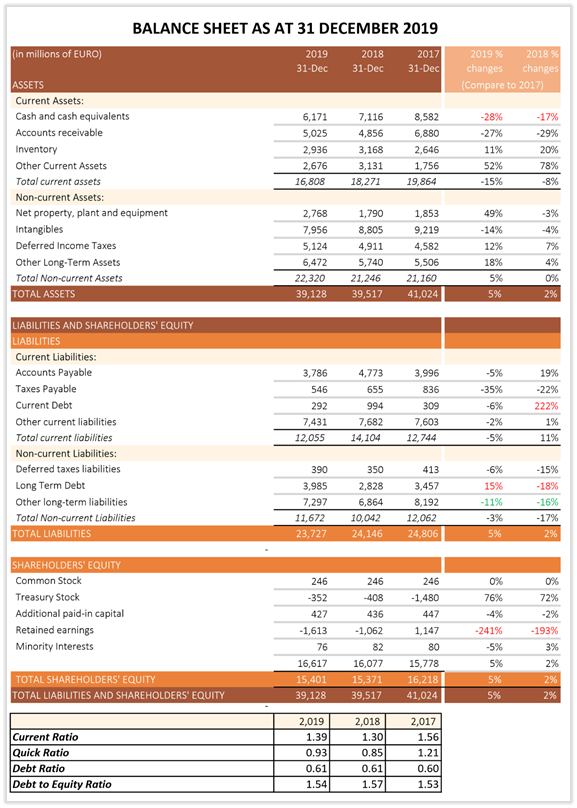

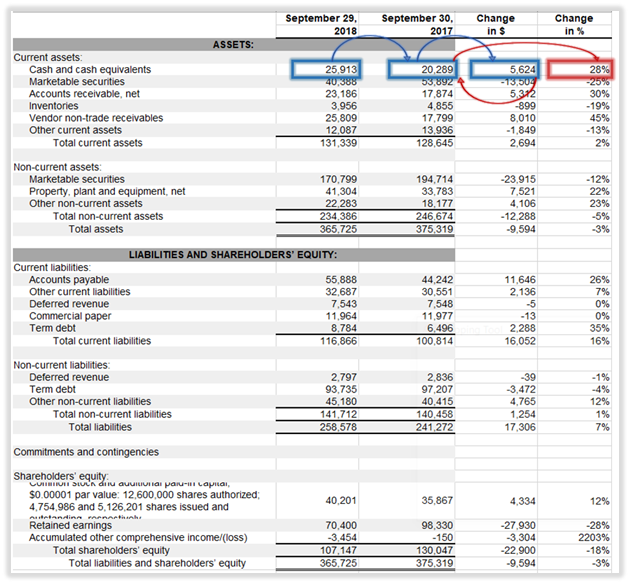

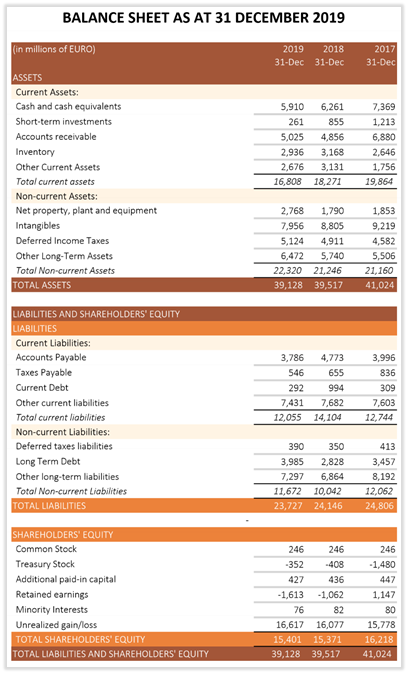

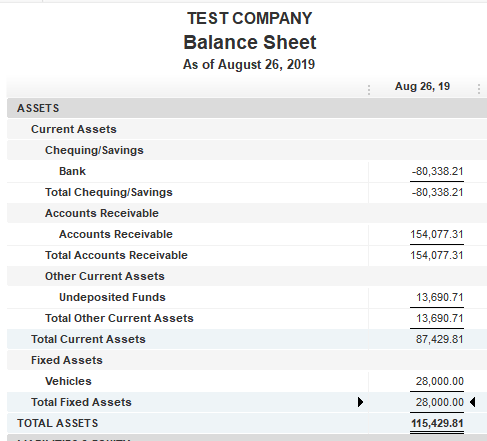

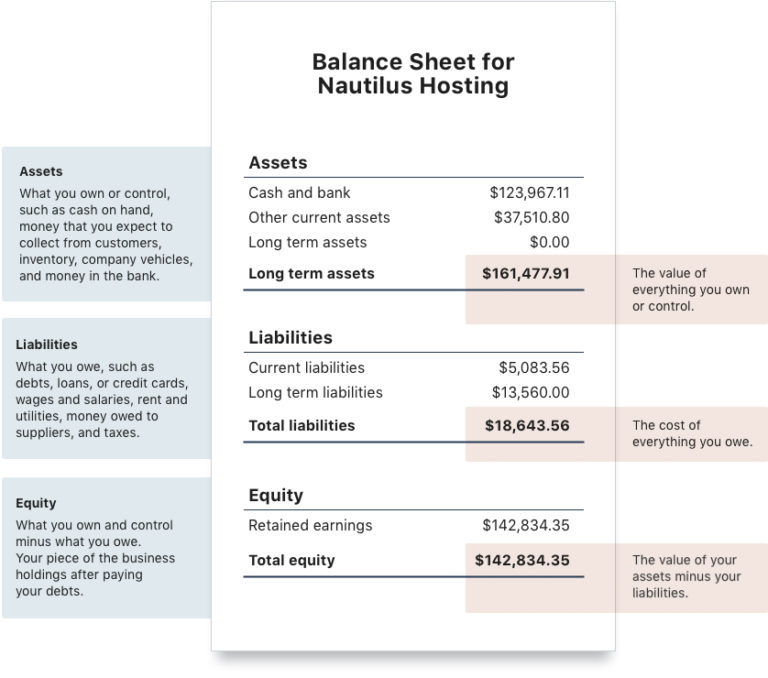

The accountant reports the current liabilities on the balance sheet at the beginning of the liabilities section.

Negative payroll liabilities balance sheet. The equity should show up at the bottom of the balance sheet as Total equity. Ad Choose Your Payroll Tools from the Premier Resource for Businesses. Deselect categories by clicking in the select column next to each payroll category you want to exclude.

If it is a negative. Payroll tax returns have been prepared and filed showing no balance due and no notices to the contrary have been received Payroll and inventory discussed elsewhere are two areas where QuickBooks is less forgiving and clients are more likely to make mistakes. Defining Negative Working Capital.

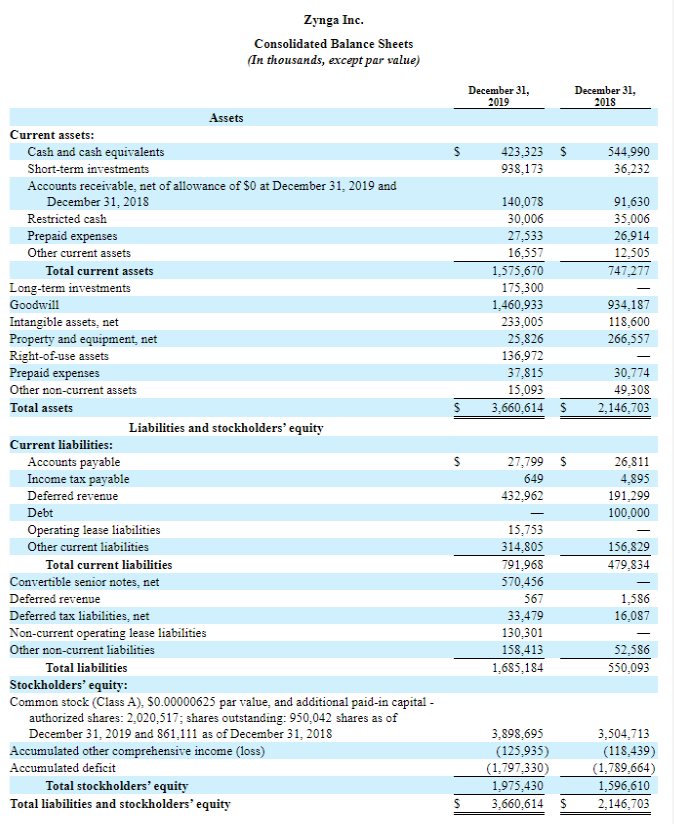

The Select from list window appears. If only one liability account has a negative sign it is likely that the liability account has a debit balance instead of the normal credit balance. Negative Goodwill - Intangible Assets.

For example if you were to accidentally pay a suppliers invoice twice the first payment would reduce the original liability record. Click the search icon in the Payroll Categories field. Payroll Liabilities Amounts owed to employees for work performed are recorded separately from accounts payable.

Ad Choose Your Payroll Tools from the Premier Resource for Businesses. Accumulated Amortization - Total Liabilities. In other words there is more short-term debt than there are short-term assets.

If a corporation has purchased its own shares of stock the cost is recorded as a debit in the account Treasury Stock. It is what the Balance sheet owes you. The most common causes of this are.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)