Outstanding Micro Entity Profit And Loss Template

Where to put Motor and travel expenses Telephone expenses Professional costsMaintenance when the template I mean HMRC template when using CT 600 Company Tax and Accounts Return Service-contain the following.

Micro entity profit and loss template. Select your company type below to go to the appropriate conversion service. Micro-entities are very small. Step 1 - What is FRS 105 and what is IXBRL.

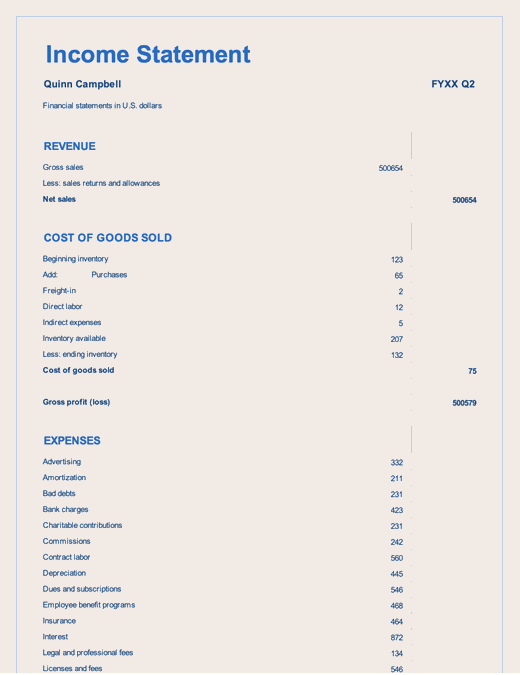

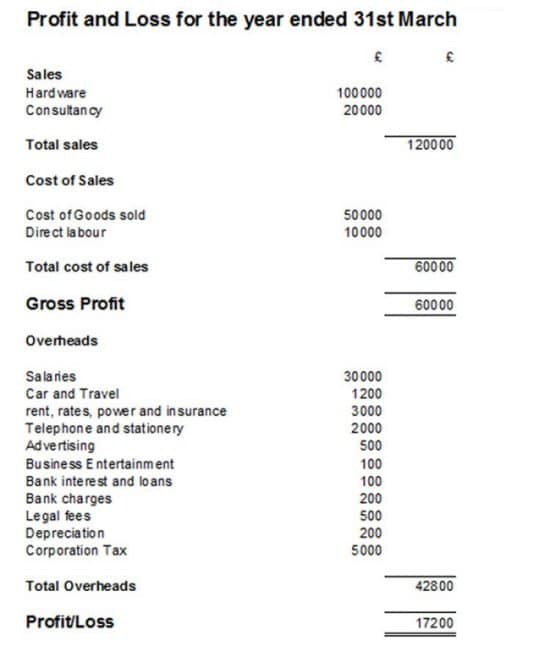

It tells you how much profit youre making or how much youre losing. A turnover of 632000 or less. Early application of these requirements is permitted for.

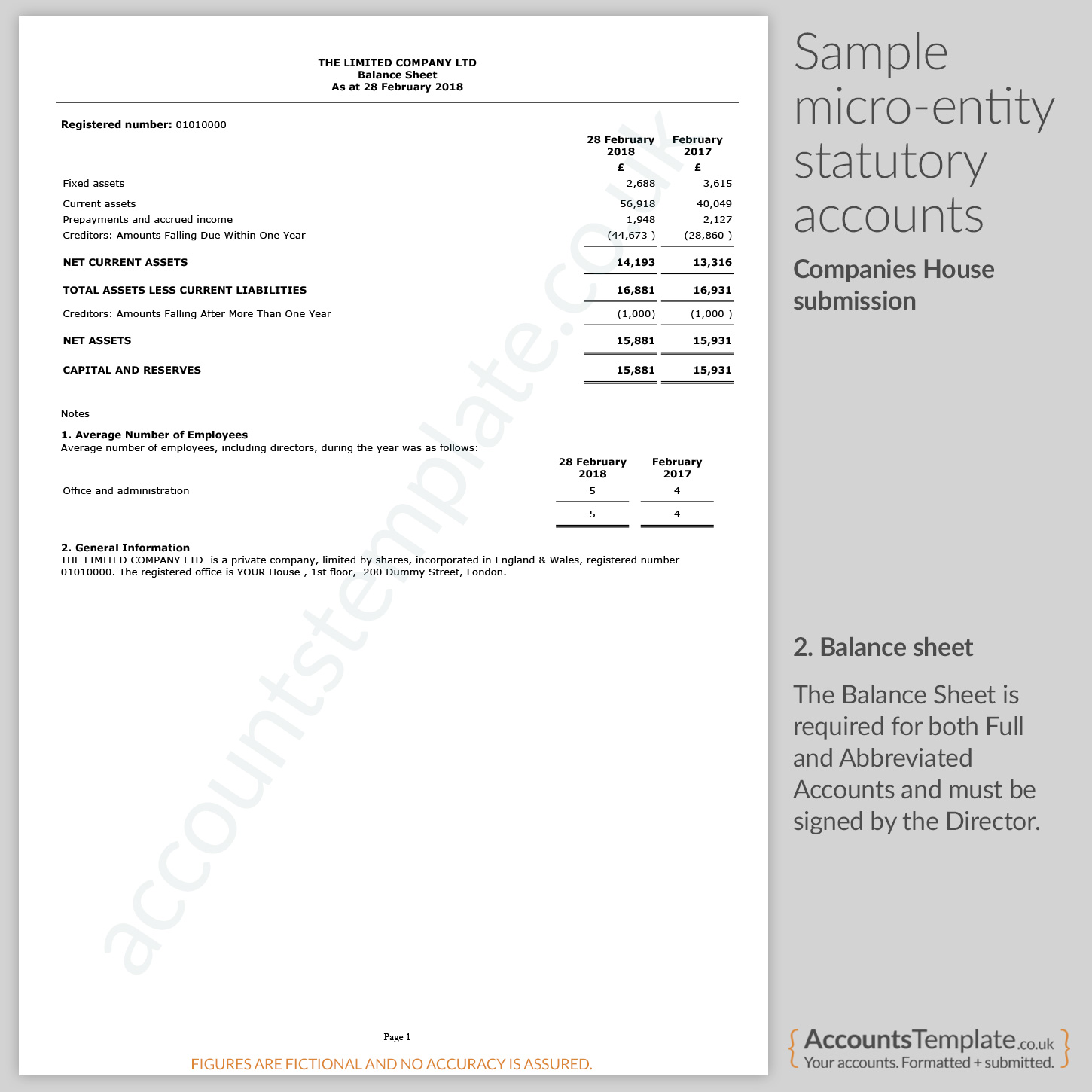

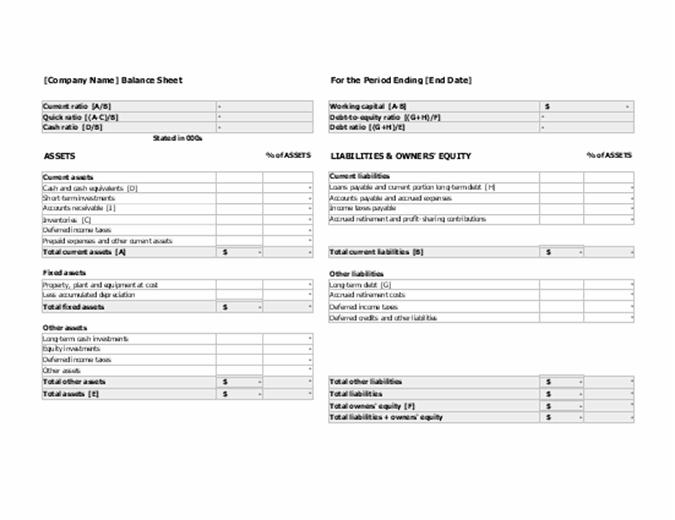

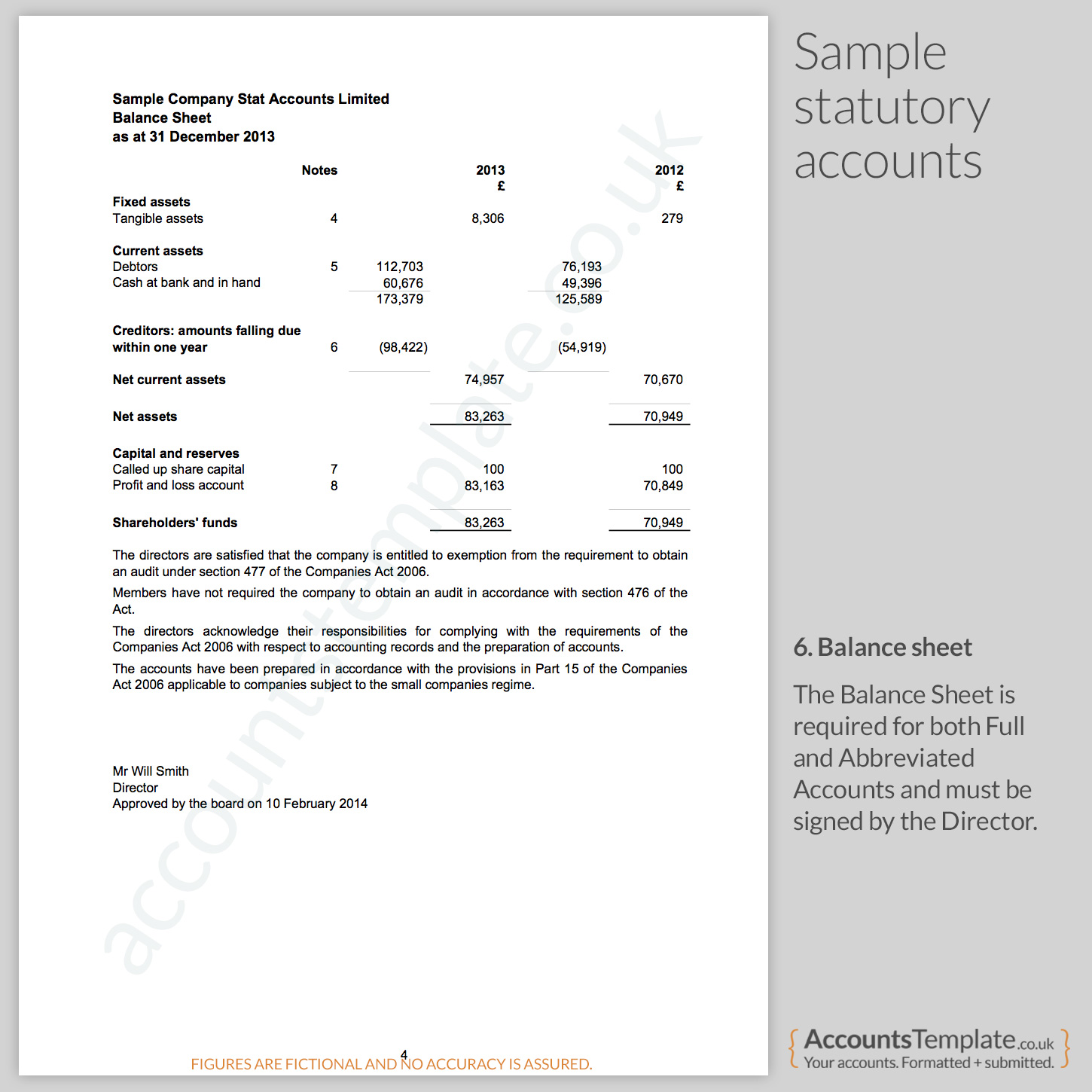

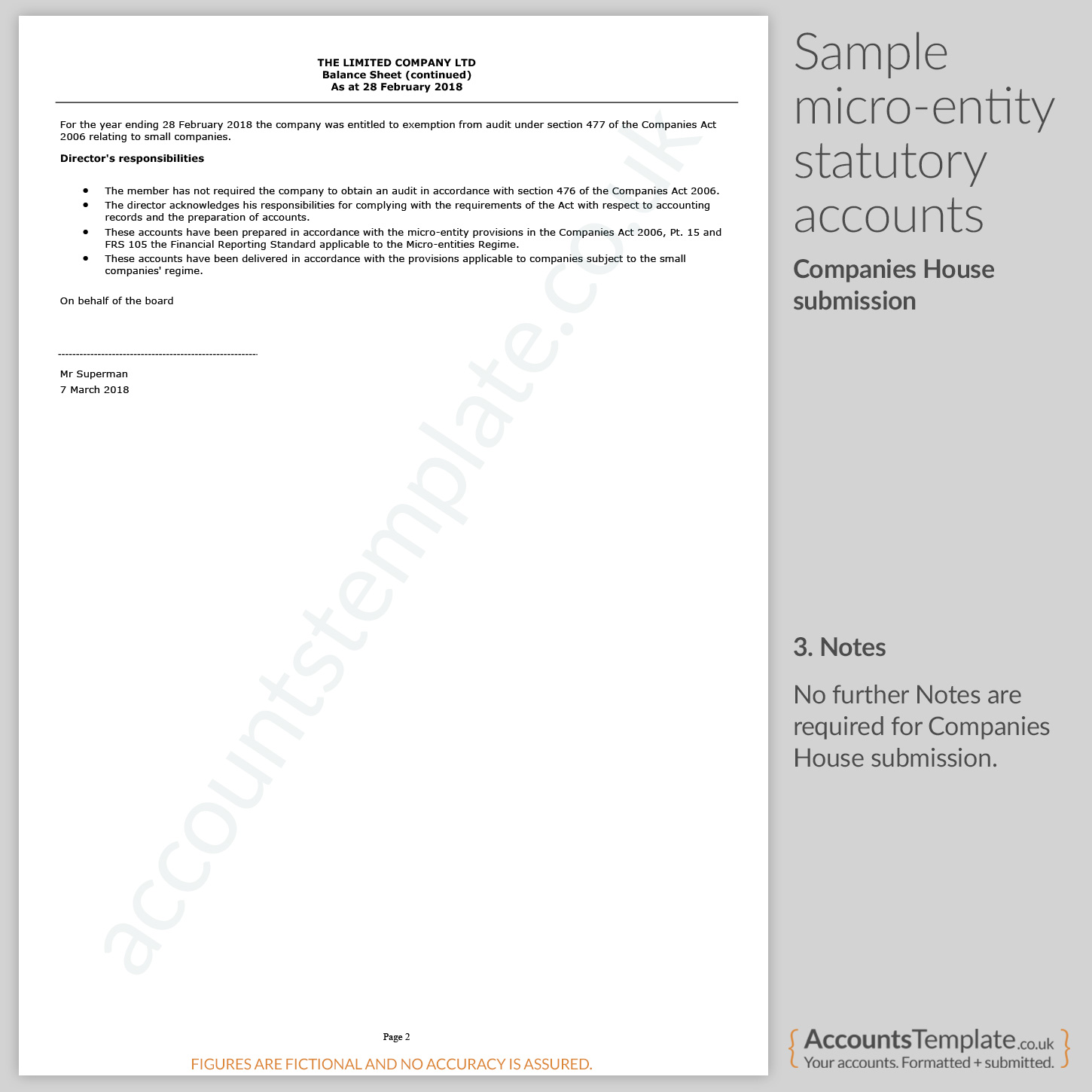

A profit and loss or income statement lists your sales and expenses. There are two formats for the balance sheet and one format for the profit and loss account. The directors of a company are required to prepare Accounts for each financial year of the company.

Create financial statements in iXBRL format using templates in Microsoft Excel for Windows. And b a profit and loss c Notes to the accounts. A balance sheet a profit and loss account.

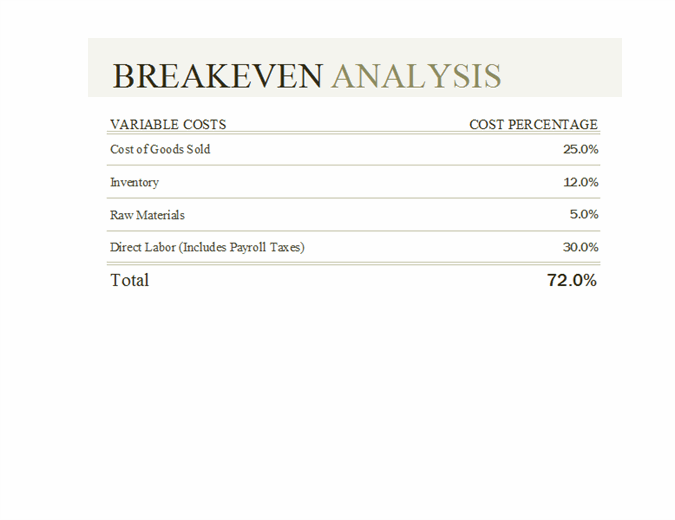

FRS 105 is a UK accounting standard for micro-entities regime. Choose whether or not to send a copy of the directors report and profit and loss account to Companies House. Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or services.

A balance sheet total of 316000 or less. 1A Small Entities of FRS 102 issued September 2015 FRS 102 applies to small companies applicable for periods commencing on or after 1 January 2016. Micro-entity accounts are a simplified format containing all the information thats.