Fantastic Income Statement Periodic System

Cost of Beginning Inventory Add.

Income statement periodic system. Under the periodic system an entry must be made in the Merchandize Inventory account to adjust this balance to the amount of inventory counted and valued at year-end. Learn how to prepare a multi-step income statement and close the accounts under the periodic inventory methodTable of Contents. Under the periodic inventory system the cost of goods sold is computed as follows.

Beginning inventory previous years ending inventory cost net purchases cost of goods available - costs computed for the ending inventory cost of goods sold. Periodic - Financial statements and closing entries - YouTube. Periodic inventory system allows a poor control over inventory of a business where you are not accounting for your lost wastage scrap units of inventory.

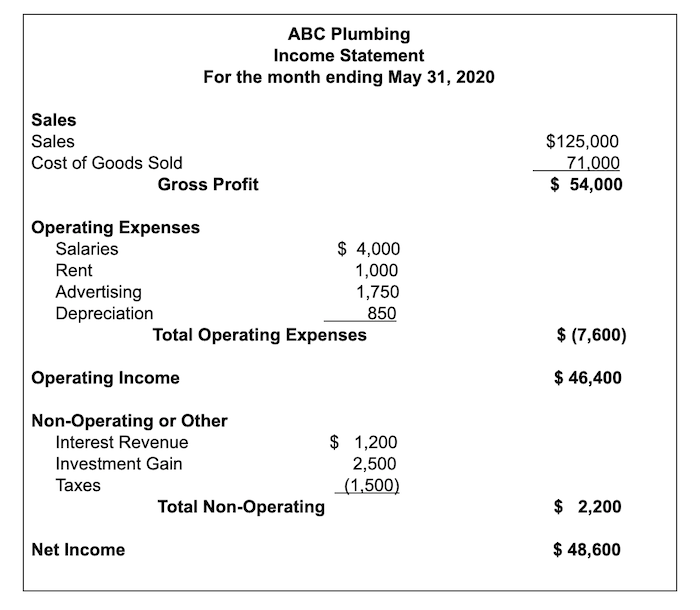

The cost of goods sold commonly referred to as COGS is a fundamental income statement account but a company using a periodic inventory system will not know the amount for. Second the title of the statement. The statement is the reality.

75 OFF the Full Crash Course on Udemy. Purchase Returns Allowances. In each case the periodic inventory system journal entries show the debit and credit account together with a brief narrative.

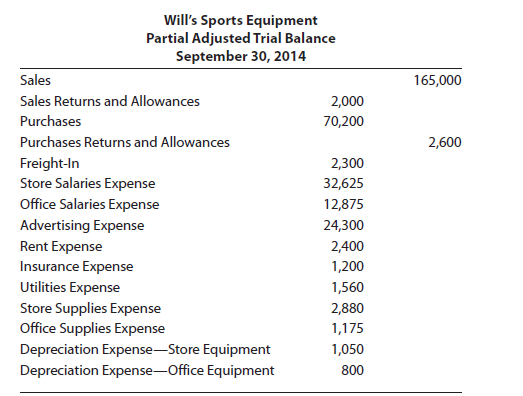

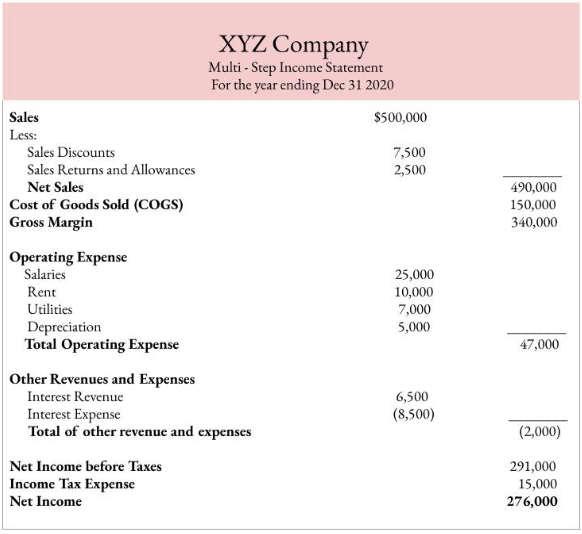

J Cansfield GRADE 12 INVENTORY SYSTEM NOTES Page 4 of 4 FINANCIAL STATEMENTS FOR PERIODIC INVENTORY SYSTEM Income Statement _____ Income Statement for. INCOME STATEMENT periodic system condensed 1 INCOME STATEMENT OF MERCHANDISING COMPANY XYZ Inc. A periodic inventory system updates and records the inventory account at certain scheduled times at the end of an operating cycle.

And third the fiscal period for which the statement is prepared. Sales Returns Allowances Sales Discounts Net Sales Less. The periodic inventory system is a software system that supports taking a periodic count of stock.