Formidable Kpmg Balance Sheet

Accounting-wise therefore they are to be shown at cost by default.

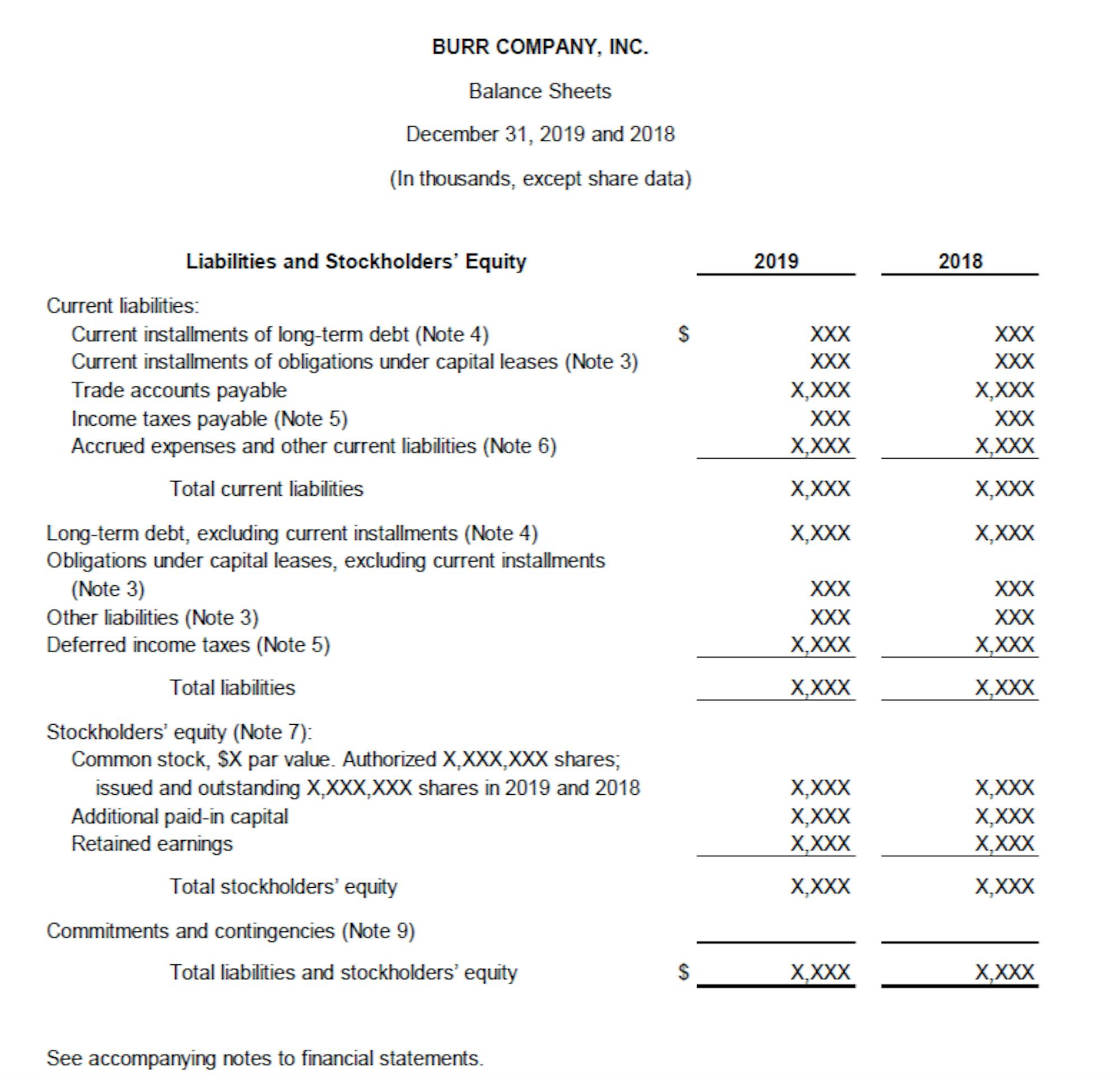

Kpmg balance sheet. The FASB is seeking to improve guidance on classifying debt on the balance sheet by introducing an overarching principle and requiring more comprehensive disclosures. Under IFRS Standards bank overdrafts reduce the cash and cash equivalents balance in the statement of cash flows if they are repayable on demand and form an integral part of the companys cash management. Under the credit impairment standard a company that has provided a guarantee recognizes a liability for the expected credit losses related to the contingent obligation.

Significant dispersion is observed across. Yet balance sheet liquidity remains below 2015 levels of 138. Example Public Company Limited is designed to help you in preparing annual financial reports in accordance with Australian Accounting Standards based on current disclosure and presentation requirements for financial years ending 31 December 2020 and 30 June 2021.

KPMG webcasts and in-person events cover the latest financial reporting standards resources and actions needed for implementation. Guarantees create off-balance sheet credit exposure if they require the guarantor to make a payment due a failure of another company to satisfy its required payment obligation. Since the financial crisis banks have faced a disparity between the returns they are required to deliver by investors and the returns they have been able to achieve.

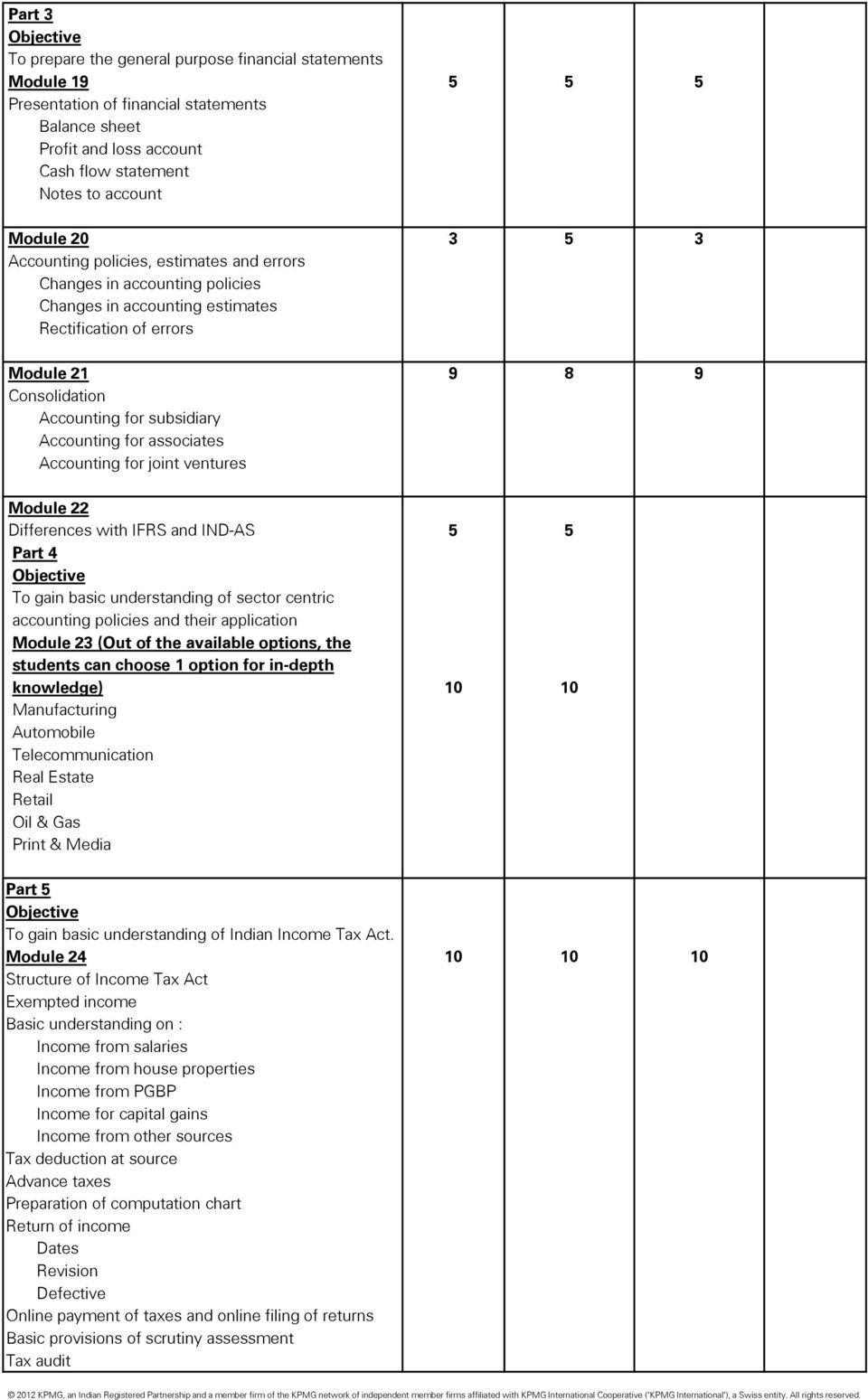

KPMG reports on the FASBs proposals to simplify debt classification. If digital currencies do not meet the definition of any financial asset current accounting rules would conclude that cryptocurrencies can be considered to be intangible assets under IAS 38 inventories under IAS 2 or as commodity broker-trader transactions exempt from IAS 2. 4 Financial highlights.

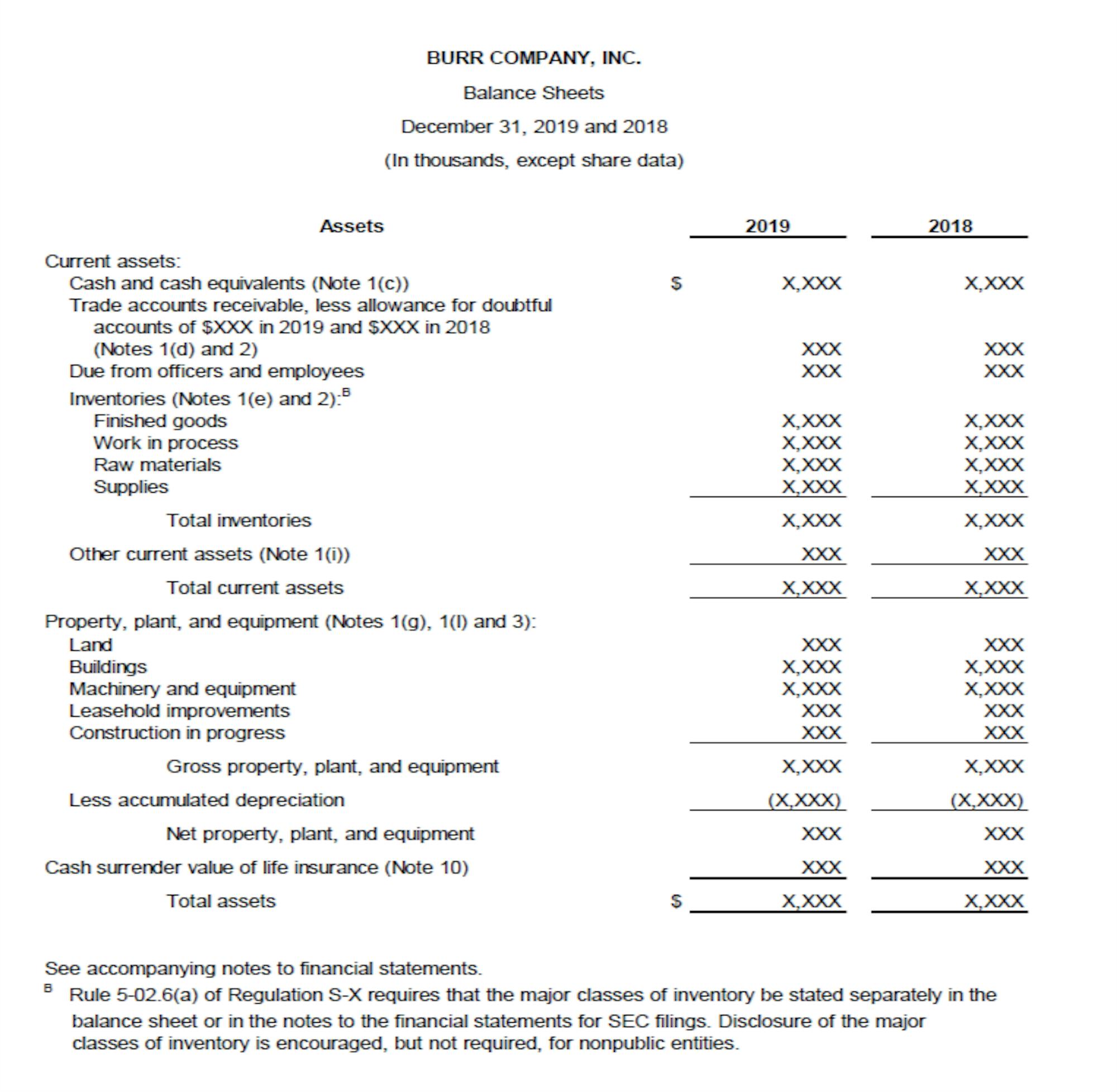

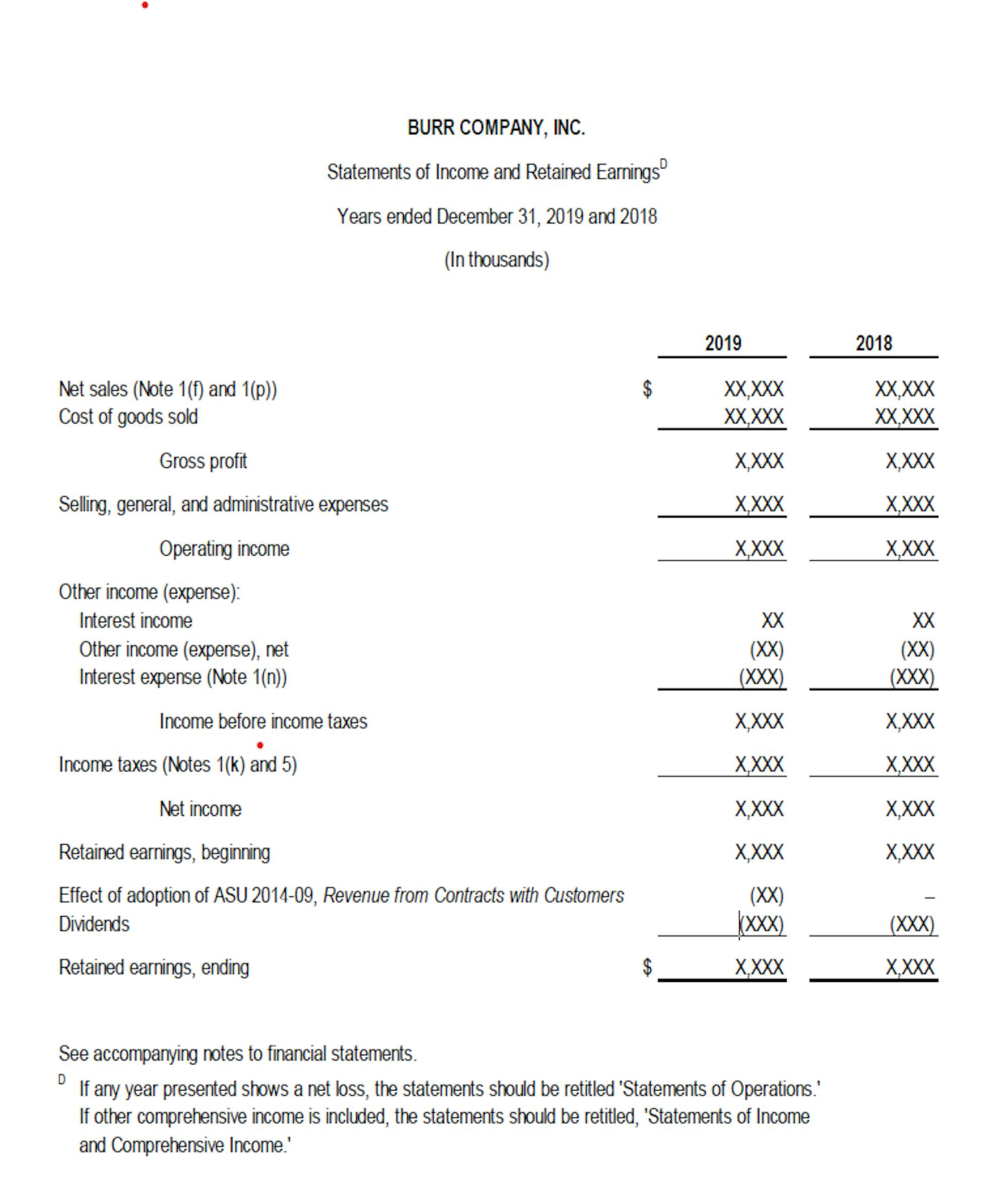

Balance sheet 74-75 Statement of changes in equity 75 Cash flow statement 75 Notes 77 CONTENTS Ant c pate tomorrow Del ver today. 1 Search for the company you require in the Tofler search bar. It is likely that the proposed amendments to ASC 470 would result in more debt arrangements being classified as current on the balance sheet.

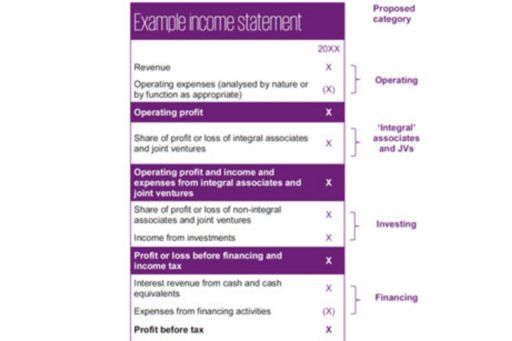

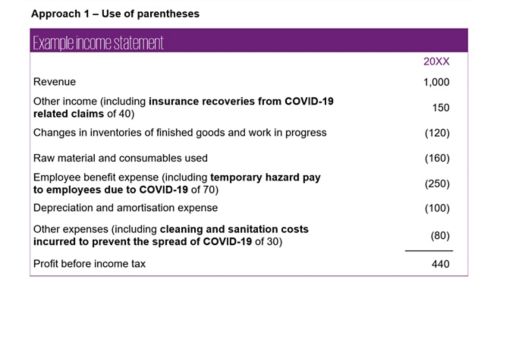

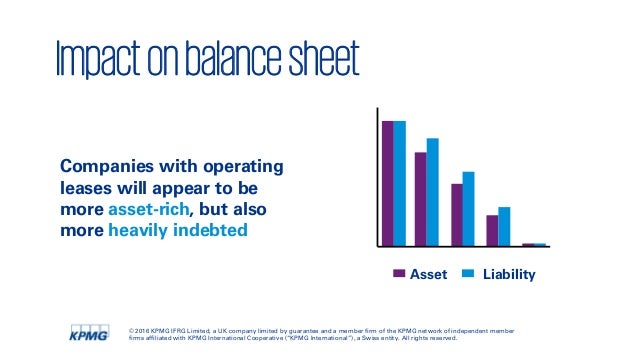

Of KPMG IFRG Limited. The returns dilemma Author. The balance sheet and the income statement.