Neat Journal Entry For Income Tax Payable

Example of Income Tax Payable.

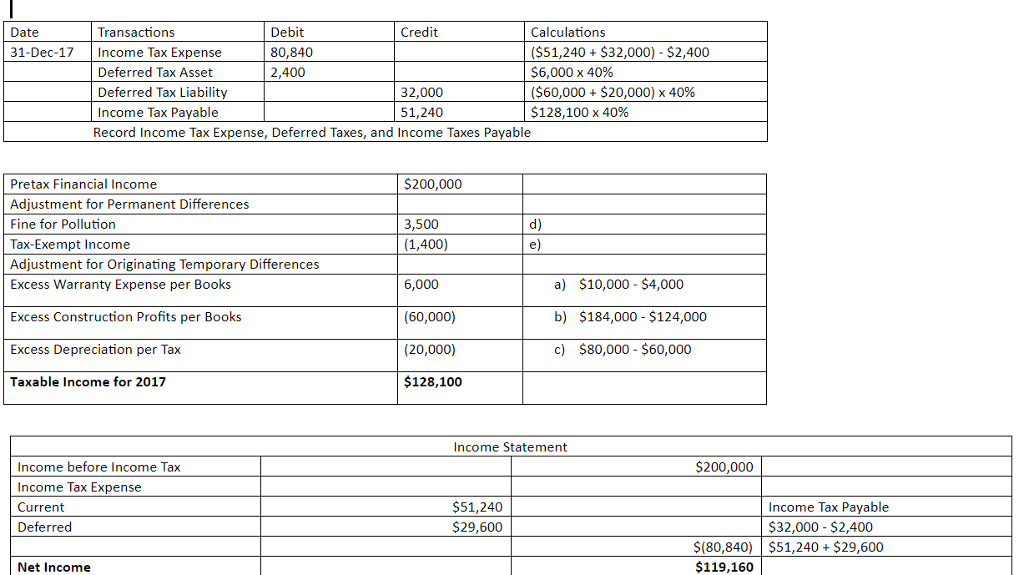

Journal entry for income tax payable. Income tax payable which is a current liability account. The bookkeeping entry would be. When payment of the corporate income taxes is made generally several months after the year end.

Credit Income Tax Payable 1425000. After you receive the anticipated refund record a second journal entry to move the refund to your Cash account. Ad Find How to do my income tax.

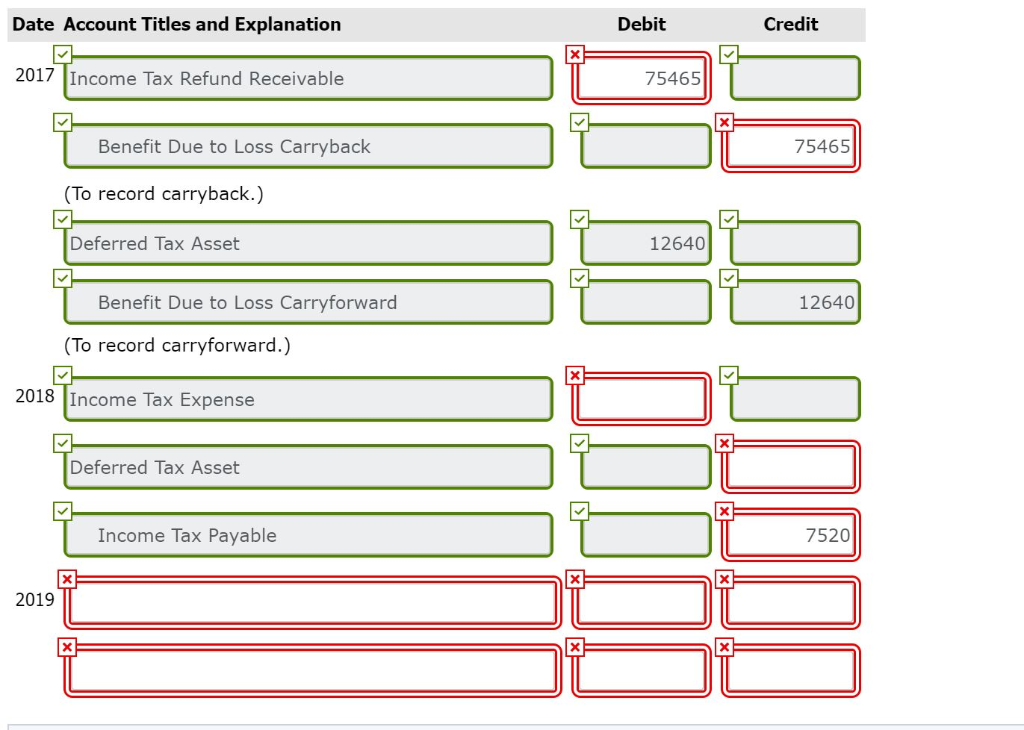

Prepare the income tax expense section of the income statement for 2007. It is generally seen in most of the cases that many people find difficulty in passing the correct journal entry for Provision of Taxation. Helen What is the journal entry for income tax re-assessment.

Debit Income Tax Expense 1425000. Journal Entry for Income Tax Income tax is a form of tax levied by the government on the income generated by a business or person. As the income tax is estimated a demand for the amount has not yet been received and the expense has not been recorded in the accounting records.

Dr Taxes Payable Liability account Cr Cash Asset account. To record the refund you received. Normally before you close your books for the year you would prepare a journal entry for estimated taxes payable.

Income taxes payable is recorded on the credit side. Debit your Cash account. When the refund we do the following.