Nice Computation Of Income Tax Format In Excel For Individuals Business

At present the income tax computation format is not available in excel word and PDF.

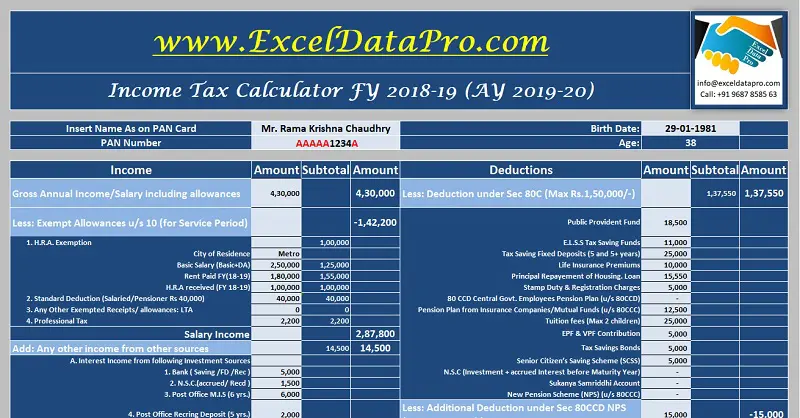

Computation of income tax format in excel for individuals business. Net Profit as per profit an d loss account. Excel based Income Tax Calculator for FY 2019-20 AY 2020-21. Profit and gains of business and profession.

Earlier I shared TradingPL Balance Sheet format in excel for business. Form of application for allotment of Tax Deduction Account Number under section 203A and Tax Collection Account Number under section 206CA of the Income-tax Act 1961. Download Income Tax Calculator FY 2020-21 AY 2021-22 in Excel Format.

CA Final Indirect Tax Laws IDT Question Paper New Course July 2021. The annual income tax payable is then automatically calculated in columns D E based on the specified user input values and the default tax calculation variable amounts which are included on the Values sheet including the tax brackets at the top of the sheet. Claim for refund of tax.

In the mean time you can copy this format to word for printing. We are preparing for you. Formula For Taxable Income is represented as.

Adjusted net annual value. Income TaxWealth taxInt On TaxPenalty On Tax Shown As ExpDeferred Tax xx Section 43 B ExpensesInterest On Bank LoanBonusPf Not Paid Till Return Filing Date 30 Sept xx Any uncertain ed Provisions Provision Made Without Any Basis EG Prov For Bad Debts xx Less Exp Allowed Like Depreciation As Per Income Tax. Salary Pension House Property 1 SOP 2 LOP along with Set off carry forward of loss therein and.

- Unabsorbed CA cd X - Current CA X - Balancing Allowance X XX STATUTORY INCOME XXX ADD. Summary of section 194Q and 206C1H GSTR 2B Matching. No formula are feeded in this feed it according to your convenienceYou.