Formidable Accounting Standard For Depreciation

The asset is carried at a revalued amount being its fair value at the date of revaluation less subsequent depreciation and impairment provided that fair value can be measured reliably.

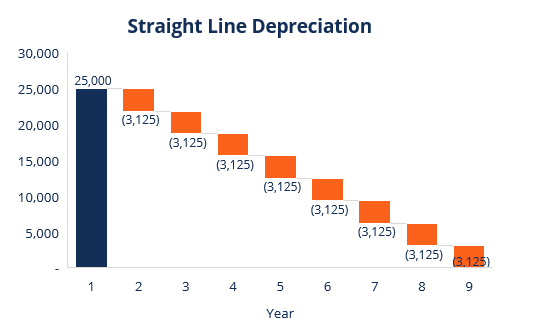

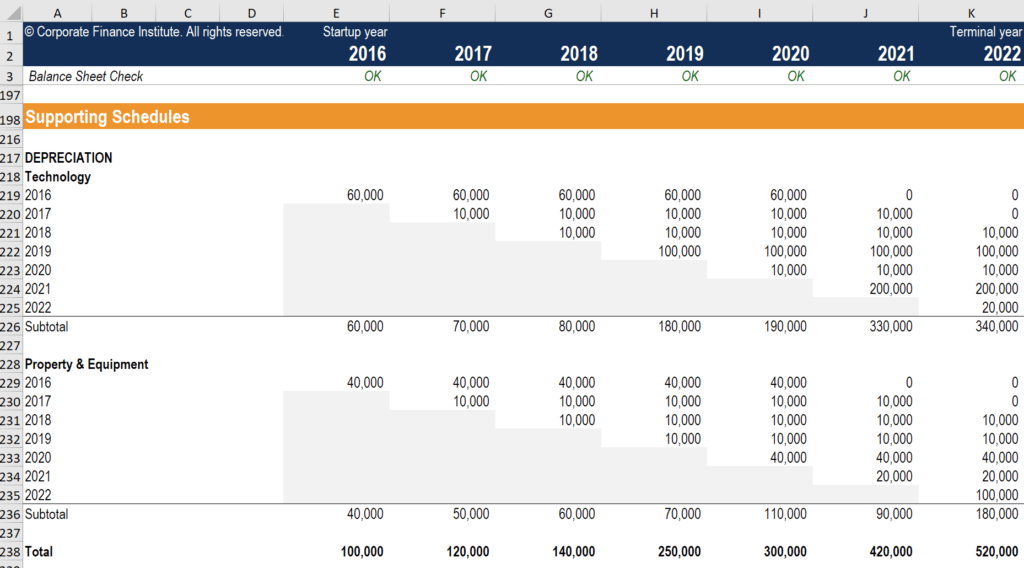

Accounting standard for depreciation. The depreciation method applied to an asset should be reviewed at least at each financial year-end and if there has been a significant change in the expected pattern of consumption of the future economic benefits embodied in the asset the method should be changed to reflect the changed pattern. Accounting Standard AS 6 requires that the company charge depreciation on a systematic basis to each accounting period during the life of an asset. IAS 1630 Revaluation model.

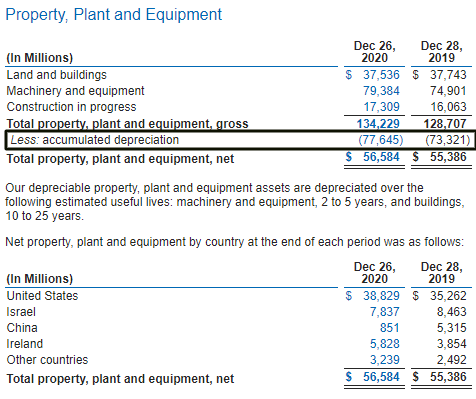

The recognition of accounting depreciation is driven by accounting standards and principles such as US GAAP. Scope 2 This Standard shall be applied in accounting for property plant and equipment except when another Standard requires or permits a different accounting treatment. The determination of their carrying amounts and the depreciation charges and impairment losses to be recognised in relation to them.

The Charities Accounting Standard is developed based on the requirements of the Financial Reporting Standards taking. Key requirements and concepts 36 61 Overview 36 62 Relationship between fair value and depreciation expense 37 63 Common concepts 38 631 Control 38 632 Future economic benefit 39. In December 2003 the Board issued a revised IAS 16 as part of its initial agenda of technical projects.

Ad See the Accounting Tools your competitors are already using - Start Now. IAS 16 permits two accounting models. It applies in its entirety to level I II and III enterprises.

AS 6 DEPRECIATION ACCOUNTING Applicability AS 6 though an old accounting standard is considered very significant as it affects the preparation and presentation of financial statements for all enterprises. Accounting standards 29 51 Types of assets 29 52 Valuation and depreciation accounting standards 29 53 IPSAS 17 Property Plant and Equipment 30 6. These are important for accounting and tax purposes and must be carefully utilized to ensure consistency compliance and preparation for an audit.

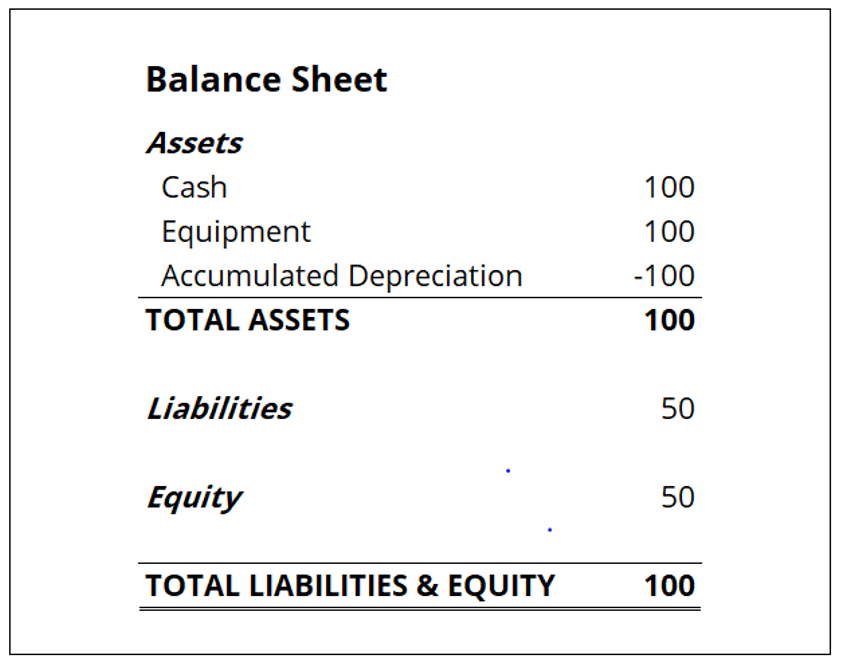

A4 The Accounting Standards Council has developed a set of accounting standards for charities the Charities Accounting Standard. The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense and eventually to derecognize it. The asset is carried at cost less accumulated depreciation and impairment.

/depreciation-accounting-2ad5d217d7cc49c396f4abfad537f7c2.jpg)